EasyJet 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Underlying financial performance 2010

£ million 2009

£ million

Underlying prot before tax 188.3 43.7

Volcanic ash disruption (27.3) –

(Loss)/prot on disposal of assets held for sale (7.0) 11.0

Reported prot before tax 154.0 54.7

The reported prot for the year includes £27.3 million of cost relating to

the volcanic ash cloud disruption in April and May 2010 as detailed above

and a £7.0 million loss associated with the disposal of the nal four ex-GB

Airways A321 aircraft in November 2010. This now completes the sale

of ex-GB Airways A321 sub-eet, generating an overall net prot of

£4.0million on the disposal of the seven aircraft.

Excluding these one off items underlying prot before tax for 2010 was

£188.3 million or £3.36 per seat (2009: £43.7 million or £0.83 per seat).

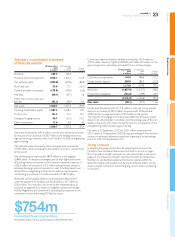

Exchange rates

Movements in exchange rates, principally the US dollar and euro,

are akeyfactor in determining the Company’s nancial performance.

Theunderlying average market rate for the US dollar in 2010 was at

compared to the prior year at 1.56/£. However, after taking into account

hedging, the effective average rate for the year was 1.64/£, down from

1.78/£ in 2009. The Company has no US dollar revenue but signicant

US dollar costs within fuel, leasing, maintenance and interest, therefore

this movement has had an adverse impact on the result for the year

compared to 2009.

The average euro market rate in 2010 has strengthened marginally from

1.16/£ in 2009 to 1.15/£ in 2010. With 44% of revenue and 34% of costs

denominated in euro, this results in a net surplus position therefore the

movement in the euro has contributed positively to the result in 2010.

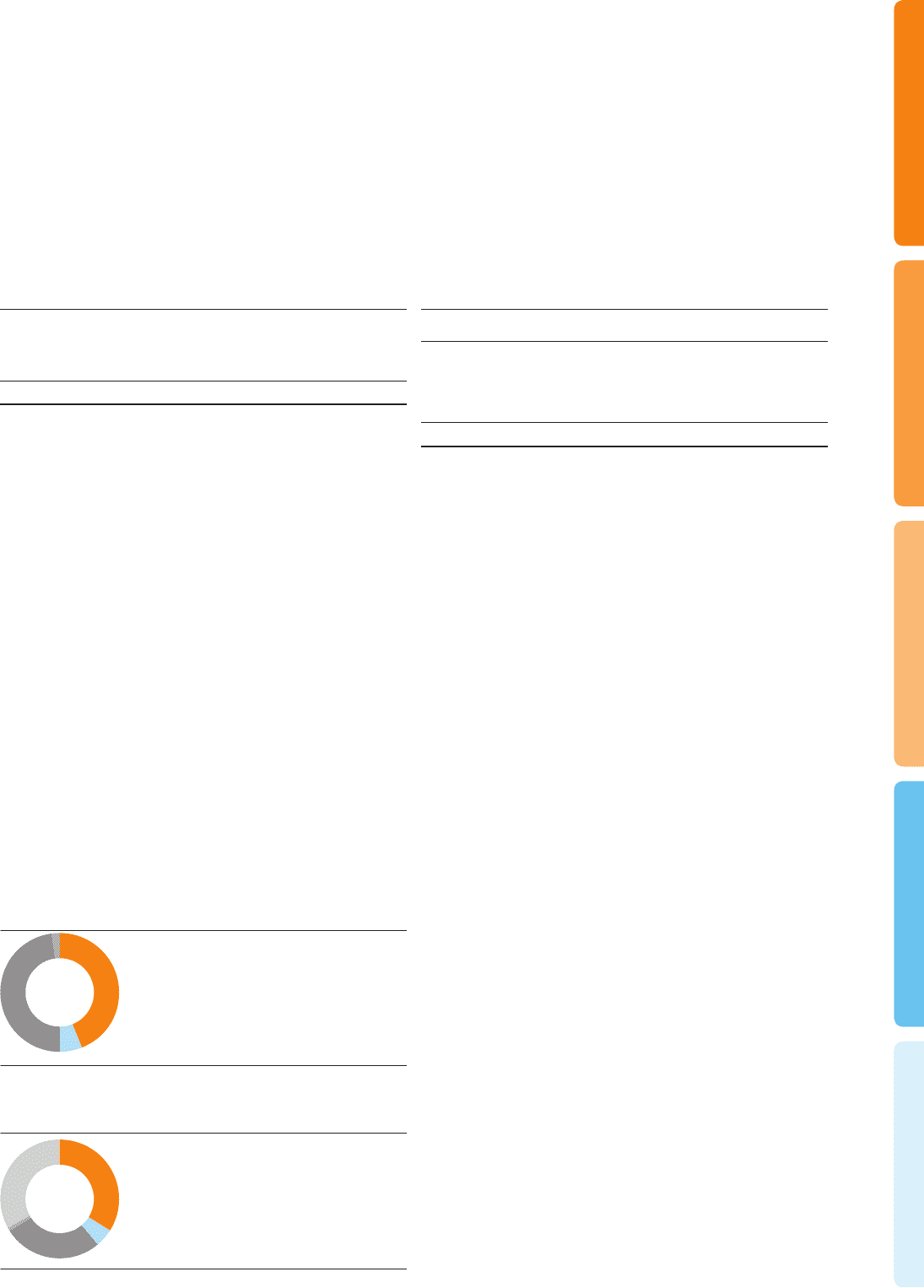

The following charts illustrate easyJet’s exposure to foreign currency in

both revenue and cost terms:

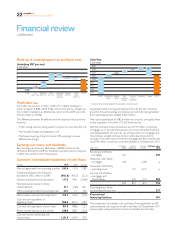

Revenue

2010 2009

£ million £ per

seat Pence

per ASK £ million £ per

seat Pence

per ASK

Passenger

revenue 2,401.7 42.87 3.81 2,150.5 40.70 3.69

Ancillary

revenue 571.4 10.20 0.91 516.3 9.77 0.89

Total revenue 2,973.1 53.07 4.72 2,666.8 50.47 4.58

In spite of the challenging economic environment, the Company

returned a strong commercial performance in 2010. Total revenue

increased 11.5% to £2,973.1 million.

Disruption in the year meant that seat capacity increased by 6.0%

whilstthere was an increase of 9.2% in the average number of aircraft

operated. This contributed to a 1.5 percentage point increase in load

factor.

Total revenue per seat increased 5.1% to £53.07 with a particularly

strong second half performance. After accounting for the positive impact

of foreign exchange, total revenue per seat at constant currency grew by

3.3%. Non-sterling currencies accounted for 52% of revenue in 2010

(2009: 51%).

This revenue increase was driven by:

– Improvements in route mix with investment in higher yielding

European routes and some capacity re-alignment within the UK

(including the closure of the East Midlands base); and

– Encouraging year-on-year performance on routes from the UK,

these performed well throughout the summer with high levels of

demand for both beach and European cities.

Ancillary revenue grew by 10.7% in 2010, or 4.4% on a per seat basis.

This was driven by a 3.3% increase in checked bag revenue per seat and

price optimisation across other fees and charges. Partner revenue was

impacted by the regulatory change which forced travel insurance to be

presented on an opt-in basis.

Total revenue

2010 currency split

■

euro 44%

■

Swiss franc 6%

■

sterling 48%

■

other 2%

Total costs

2010 currency split

■

euro 34%

■

Swiss franc 5%

■

sterling 27%

■

other 1%

■

US dollar 33%

Overview Business review Governance Accounts Other information

19

easyJet plc

Annual report and accounts 2010