EasyJet 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2010

Report on Directors’ remuneration

continued

52

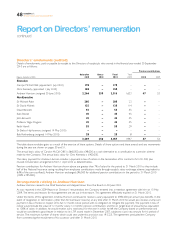

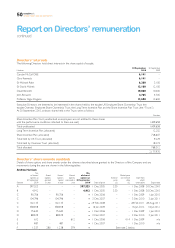

The actual targets that applied to the awards of performance shares made to Executive Directors during the year under review were

as follows:

Awards up to 100% of salary

Threshold

(25% vests)

Target

(50% vests)

Maximum

(100% vests)

Return on equity (year ending 30 September 2012) 9.0% 12.0% 15.0%

Awards over to 100% of salary

Threshold

(25% vests)

Target

(50% vests)

Maximum

(100% vests)

Return on equity (year ending 30 September 2012) 11.0% 13.0% 15.0%

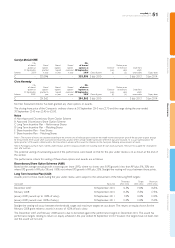

Matching Share Awards

No matching shares were granted to Executive Directors in the year under review.

Position against dilution limits

easyJet complies with the 5% in five years guidelines on share dilution and current dilution is 2.5%. It is the intention of easyJet to source

shares by market purchase, rather than by the issue of new shares. The requirement for shares under all current share-based schemes will

be met by market purchased shares (LTIP, Share Saving and Share Incentive Plans). The remaining options under the Discretionary Share

Option Schemes will continue to be met from new issue shares.

Potential vesting of outstanding awards

The table below shows how vesting of outstanding share awards would take place if the performance was based on that for the year

under review.

Grant date Actual basis year Vesting

December 2007 30 September 2010 0%

February 2008 30 September 2010 0%

January 2009 30 September 2011 0%

December 2009 and July 2010 30 September 2012 0%

On behalf of the Board

Keith Hamill

Remuneration Committee Chairman

15 November 2010