Classmates.com 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

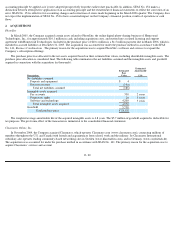

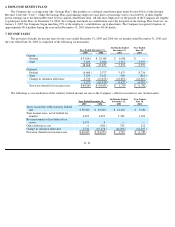

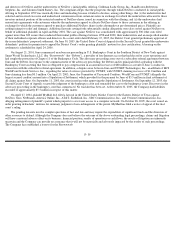

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive income (loss) is as follows (in thousands):

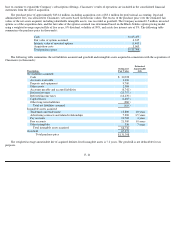

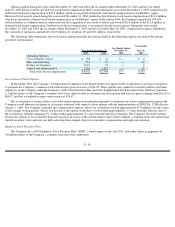

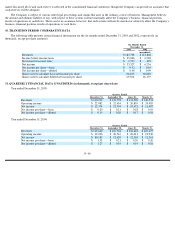

5. NET INCOME PER SHARE

The following table sets forth the computation of basic and diluted net income per share for the years ended December 31, 2005 and 2004,

the six months ended December 31, 2003 and the year ended June 30, 2003 (in thousands, except per share amounts):

The diluted per share computations exclude options, unvested common stock and warrants, which are antidilutive. The number of

antidilutive shares at December 31, 2005, 2004 and 2003 and June 30, 2003 was 6.8 million, 6.4 million, 1.1 million and 4.8 million,

respectively.

F- 30

Unrealized

gain (loss) on

short-term

investments,

net of tax

Unrealized

gain on

derivative,

net of tax

Foreign

currency

translation

Accumulated

Other

Comprehensive

Income (Loss)

Balance at June 30, 2002

$

1,015

$

—

$

—

$

1,015

Current period change

1,429

—

—

1,429

Balance at June 30, 2003

2,444

—

—

2,444

Current period change

(796

)

—

—

(

796

)

Balance at December 31, 2003

1,648

—

—

1,648

Current period change

(1,666

)

—

9

(1,657

)

Balance at December 31, 2004

(18

)

—

9

(9

)

Current period change

(282

)

83

(119

)

(318

)

Balance at December 31, 2005

$

(300

)

$

83

$

(110

)

$

(327

)

Year Ended December 31,

Six Months Ended

December 31,

Year Ended

June 30,

2005

2004

2003

2003

Numerator:

Net income

$

47,127

$

117,480

$

33,327

$

27,792

Denominator:

Weighted average common shares

—

basic

61,641

62,012

64,419

62,148

Adjustment to weighted average for

common shares subject to repurchase

(506

)

(608

)

(256

)

(460

)

Adjusted weighted average common shares—

basic

61,135

61,404

64,163

61,688

Effect of dilutive securities:

Stock options, restricted shares, warrants and

employee stock purchase plan

shares

2,680

3,608

5,341

5,386

Weighted average common shares—

diluted

63,815

65,012

69,504

67,074

Net income per share

—basic

$

0.77

$

1.91

$

0.52

$

0.45

Net income per share

—diluted

$

0.74

$

1.81

$

0.48

$

0.41