Classmates.com 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

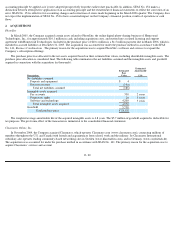

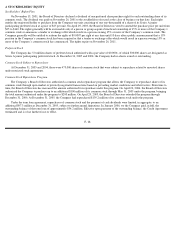

Goodwill and Intangible Assets

The changes in goodwill for the years ended December 31, 2004 and 2005 were as follows (in thousands):

The adjustment to Classmates’ goodwill is primarily due to an increase in deferred tax assets for tax benefits associated with expense

deductions and a reduction in deferred tax liabilities due to an adjustment in the state income tax rate expected to apply to future reversals of

acquired book/tax basis differences.

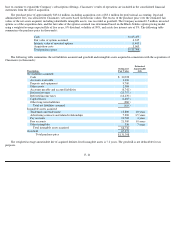

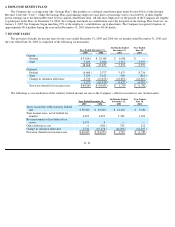

Intangible assets consist of the following (in thousands):

The Company recorded a reduction in intangible assets of approximately $11.2 million during the December 2004 quarter in connection

with the release of the deferred tax valuation allowance.

Amortization expense for the years ended December 31, 2005 and 2004, the six months ended December 31, 2003 and the year ended

June 30, 2003 was $21.8 million, $20.4 million, $7.9 million and $16.4 million, respectively.

F- 25

Balance at December 31, 2003

$

9,541

Goodwill recorded in connection with acquisitions

76,458

Recognition of acquired deferred tax assets

(9,541

)

Balance at December 31, 2004

76,458

Adjustments to Classmates

’

goodwill

(1,697

)

Goodwill recorded in connection with PhotoSite acquisition

5,738

Balance at December 31, 2005

$

80,499

December 31, 2005

Cost

Accumulated

Amortization

Net

Pay accounts and free accounts

$

98,732

$

(66,103

)

$

32,629

Trademarks and trade names

21,952

(4,254

)

17,698

Advertising contracts and related relationships

7,200

(3,871

)

3,329

Software and technology

9,280

(4,691

)

4,589

Patents, domain names and other

3,247

(2,154

)

1,093

Total

$

140,411

$

(81,073

)

$

59,338

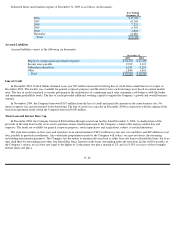

December 31, 2004

Cost

Accumulated

Amortization

Net

Pay accounts and free accounts

$

98,402

$

(51,736

)

$

46,666

Trademarks and trade names

15,952

(1,879

)

14,073

Advertising contracts and related relationships

7,200

(527

)

6,673

Software and technology

4,970

(3,285

)

1,685

Patents, domain names and other

3,309

(1,848

)

1,461

Total

$

129,833

$

(59,275

)

$

70,558