Classmates.com 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In August 2005, the Company approved stock option grants of 0.3 million to certain of the Company’s executive officers with exercise

prices ranging from $11.77 per share to $12.47 per share. The options vest 25% after one year and monthly thereafter for three years. In addition,

the Company issued 0.2 million RSUs to these executive officers. Each RSU entitles the officer to receive one share of the Company’s common

stock upon vesting. The units vest 25% annually over the four-year period beginning August 15, 2005. In connection with these units, the

Company recorded deferred stock-based compensation of $2.5 million, which is being amortized over the vesting period.

In February 2006, the Company announced its intention to offer eligible employees of the Company the opportunity to exchange any

outstanding stock options granted to them which have an exercise price per share of the Company’s common stock at or above $16.00 (the

“Eligible Options”) in return for RSUs. The number of RSUs that will be issued in exchange for each tendered Eligible Option will be based on

the per share exercise price of that option and will, in all events, be less than the number of shares subject to the tendered option. Eligible options

with exercise prices between $16.00 and $20.00 will be exchanged based on a ratio of one RSU for four eligible options. Eligible options with

exercise prices greater than $20.00 will be exchanged based on a ratio of one RSU for five eligible options. There are approximately 1.9 million

Eligible Options, which could be exchanged for approximately 0.4 million RSUs.

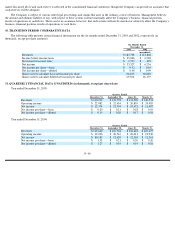

9. COMMITMENTS AND CONTINGENCIES

Financial Commitments

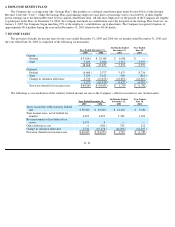

The Company’s financial commitments at December 31, 2005 are as follows (in thousands):

(1)

Our variable-rate term loan accrues interest at rates generally equal to the London inter-

bank offered rate (LIBOR) for dollar deposits plus a

margin of 3.0%. The table reflects only principal amounts. In January 2006, we paid in full the outstanding balance of the term loan of

approximately $54.2 million. See Note 3.

(2)

The Company has entered into certain noncancelable lease obligations for computer and office equipment. The future minimum lease

payments are discounted using varying rates over the lease terms. Amounts i nclude $33,000 of imputed interest.

The Company leases its facilities under operating leases expiring at various periods through 2014. The leases generally contain annual

escalation provisions as well as renewal options. Total rental expense for operating leases for the years ended December 31, 2005 and 2004, the

six months ended December 31, 2003 and the year ended June 30, 2003 was $6.5 million, $4.3 million, $1.3 million and $3.3 million,

respectively.

Legal Contingencies

On April 20, 2001, Jodi Bernstein, on behalf of himself and all others similarly situated, filed a lawsuit in the United States District Court

for the Southern District of New York against NetZero, certain officers

F- 38

Year Ending December 31,

Contractual Obligations:

Total

2006

2007

2008

2009

2010

Thereafter

Term loan(1)

$

54,208

$

16,498

$

16,498

$

21,212

$

—

$

—

$

—

Capital leases(2)

731

399

332

—

—

—

—

Operating leases

46,638

6,979

7,155

7,162

6,078

4,464

14,800

Telecommunications purchases

19,388

10,892

8,496

—

—

—

—

Media purchases

8,398

8,398

—

—

—

—

—

Total

$

129,363

$

43,166

$

32,481

$

28,374

$

6,078

$

4,464

$

14,800