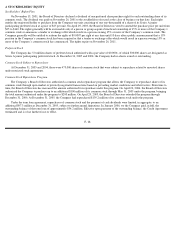

Classmates.com 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

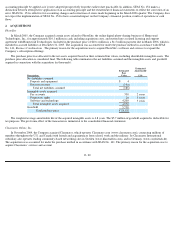

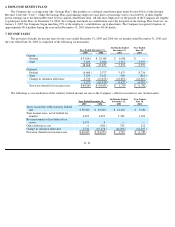

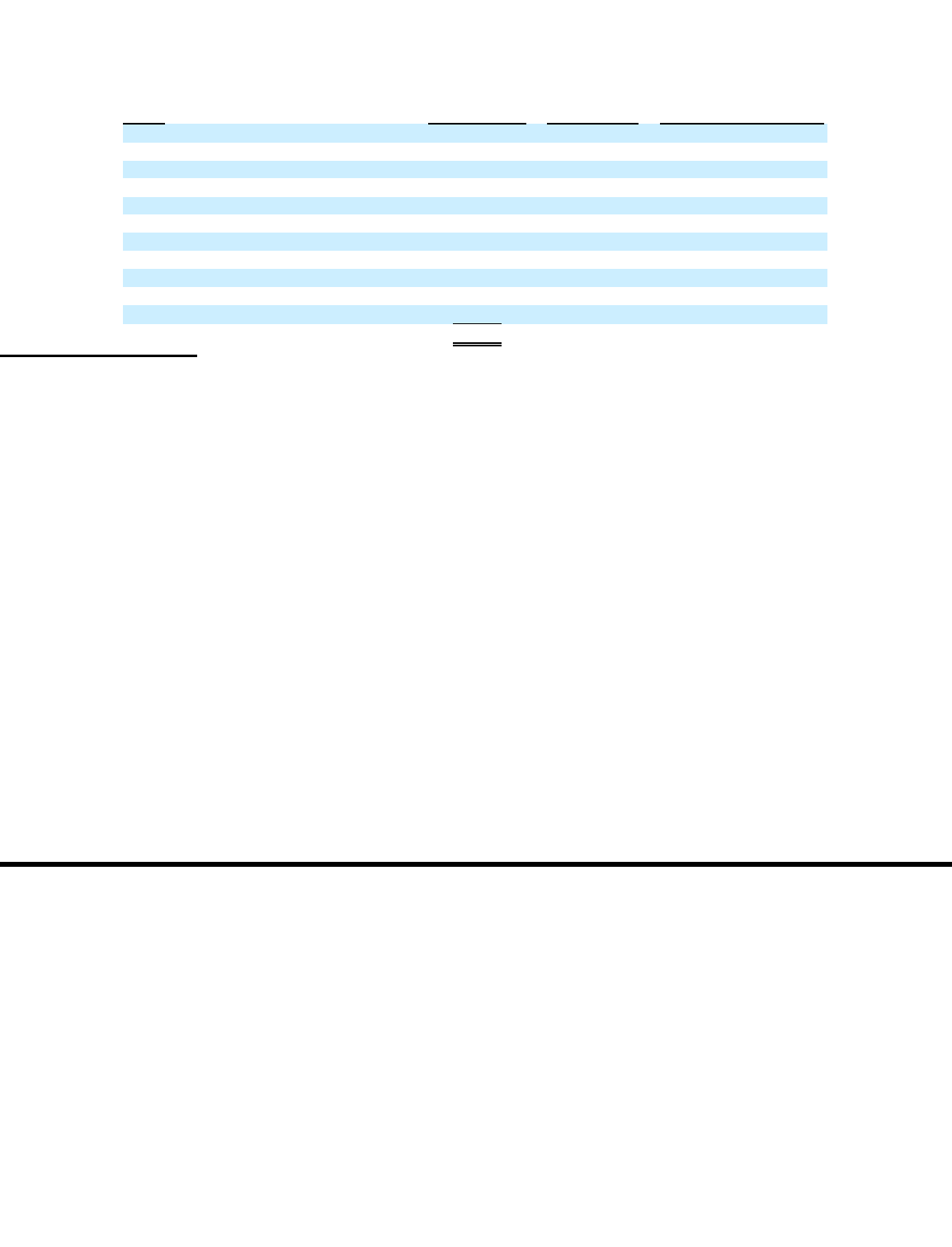

Share repurchases executed under the common stock repurchase program at December 31, 2005 were as follows (in thousands, except per

share amounts):

(1)

All shares were repurchased as part of a publicly announced program.

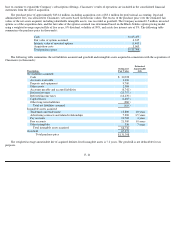

Dividends

In May, August and October of 2005, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share of common

stock. The quarterly dividends were paid on May 31, 2005, August 31, 2005 and November 30, 2005 and totaled $12.6 million, $12.7 million

and $12.8 million, respectively.

The Company’

s Board of Directors declared a quarterly dividend in February 2006, which was paid on February 28, 2006 and totaled $12.9

million.

The payment of future dividends is discretionary and will be subject to determination by the Board of Directors each quarter following its

review of the Company’s financial performance. Dividends declared and paid are not a return of profits but rather a distribution of amounts paid

in by the stockholders.

Under the term loan agreement, repurchases of common stock and the payment of cash dividends were limited, in aggregate, to an

additional $97.3 million at December 31, 2005, subject to further annual limitations. In January 2006, the Company paid, in full, the outstanding

balance of the term loan of approximately $54.2 million. Effective upon payment of the outstanding balance, the Credit Agreement terminated

and is of no further force or effect.

Tender Offer

In November 2004, the Company commenced a modified Dutch auction tender offer to repurchase up to 14.3 million shares of its common

stock at a price ranging from $9.00 to $10.50 per share. The tender offer expired in December 2004, and the Company repurchased 37,662

shares at $10.50 per share, excluding fees and expenses.

F- 29

Period

Shares

Repurchased(1)

Average Price

Paid per Share

Maximum Approximate

Dollar Value that May

Yet be Purchased Under the

Program

August 2001

138

$

1.67

$

9,770

November 2001

469

1.77

8,940

February 2002

727

3.38

6,485

August 2002

288

7.51

27,820

February 2003

193

9.43

26,005

May 2003

281

13.51

22,207

November 2003

2,024

19.76

48,706

February 2004

2,887

16.86

—

May 2004

—

—

100,000

August 2004

2,657

9.41

74,989

February 2005

1,268

11.20

60,782

Total

10,932

$

12.74