Classmates.com 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

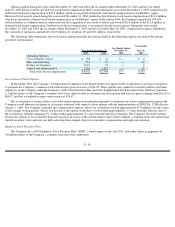

and directors of NetZero and the underwriters of NetZero’s initial public offering, Goldman Sachs Group, Inc., BancBoston Robertson

Stephens, Inc. and Salomon Smith Barney, Inc. The complaint alleges that the prospectus through which NetZero conducted its initial public

offering in September 1999 was materially false and misleading because it failed to disclose, among other things, that (i) the underwriters had

solicited and received excessive and undisclosed commissions from certain investors in exchange for which the underwriters allocated to those

investors material portions of the restricted number of NetZero shares issued in connection with the offering; and (ii) the underwriters had

entered into agreements with customers whereby the underwriters agreed to allocate NetZero shares to those customers in the offering in

exchange for which the customers agreed to purchase additional NetZero shares in the aftermarket at pre-determined prices. Plaintiffs are

seeking injunctive relief and damages. Additional lawsuits setting forth substantially similar allegations were also served against NetZero on

behalf of additional plaintiffs in April and May 2001. The case against NetZero was consolidated with approximately 300 other suits filed

against more than 300 issuers that conducted their initial public offerings between 1998 and 2000, their underwriters and an unspecified number

of their individual corporate officers and directors. In a court order dated February 15, 2005, the District Court granted preliminary approval of

the issuer defendants’ proposed settlement. On June 30, 2005, the United States Court of Appeals for the Second Circuit granted the underwriter

defendants’ petition for permission to appeal the District Court’s order granting plaintiffs’ motion for class certification. A hearing on the

settlement is scheduled for April 24, 2006.

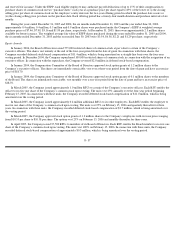

On August 21, 2001, Juno commenced an adversary proceeding in U.S. Bankruptcy Court in the Southern District of New York against

Smart World Technologies, LLC, dba “Freewwweb” (the “Debtor”), a provider of free Internet access that had elected to cease operations and

had sought the protection of Chapter 11 of the Bankruptcy Code. The adversary proceeding arose out of a subscriber referral agreement between

Juno and the Debtor. In response to the commencement of the adversary proceeding, the Debtor and its principals filed a pleading with the

Bankruptcy Court asserting that Juno is obligated to pay compensation in an amount in excess of $80 million as a result of Juno’s conduct in

connection with the subscriber referral agreement. In addition, a dispute arose between Juno and UUNET Technologies, Inc., an affiliate of MCI

WorldCom Network Services, Inc., regarding the value of services provided by UUNET, with UUNET claiming in excess of $1.0 million and

Juno claiming less than $0.3 million. On April 25, 2003, Juno, the Committee of Unsecured Creditors, WorldCom and UUNET (allegedly the

largest secured creditor) entered into a Stipulation of Settlement, which provided for the payment by Juno of $5.5 million in final settlement of

all claims against Juno. On September 11, 2003, the court issued an order approving the Stipulation of Settlement. On September 12, 2005, the

Second Circuit Court of Appeals vacated the judgment of the bankruptcy court and remanded the case to the bankruptcy court. Discovery in the

adversary proceeding in the bankruptcy court has commenced. No trial date has been set. At December 31, 2005, the Company had liabilities

recorded of approximately $5.5 million in respect of this matter.

On April 27, 2004, plaintiff MyMail Ltd. filed a lawsuit in the United States District Court for the Eastern District of Texas against

NetZero, Juno, NetBrands, America Online, Inc., AT&T, EarthLink, Inc., SBC Communications, Inc., and Verizon Communications, Inc.

alleging infringement of plaintiff’s patent which purports to cover user access to a computer network. On October 28, 2005, the court issued an

order granting defendants’ motions for summary judgment of non-infringement of the patent. MyMail has filed a notice of appeal of the trial

court’s ruling.

The pending lawsuits involve complex questions of fact and law and may require the expenditure of significant funds and the diversion of

other resources to defend. Although the Company does not believe the outcome of the above outstanding legal proceedings, claims and litigation

will have a material adverse effect on its business, financial position, results of operations or cash flows, the results of litigation are inherently

uncertain and the Company can provide no assurance that it will not be materially and adversely impacted by the results of such proceedings.

The Company has established a reserve for the Freewwweb

F- 39