Classmates.com 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

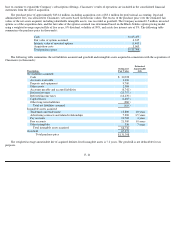

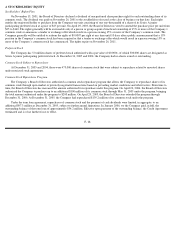

Estimated future amortization expense at December 31, 2005 is as follows (in thousands):

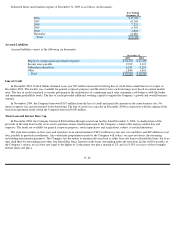

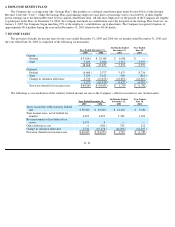

Accrued Liabilities

Accrued liabilities consist of the following (in thousands):

Line of Credit

In December 2003, United Online obtained a one-year $25 million unsecured revolving line of credit from a bank that was to expire in

December 2004. This facility was available for general corporate purposes and the interest rates on borrowings were based on current market

rates. The line of credit contained covenants pertaining to the maintenance of a minimum quick ratio, minimum cash balances with the lender

and minimum profitability levels. The line of credit provided additional working capital to support the Company’s growth and overall business

strategy.

In November 2004, the Company borrowed $10.3 million from the line of credit and repaid the amount on the same business day. No

interest expense was incurred related to the borrowing. The line of credit was canceled in December 2004 in connection with the signing of the

term loan agreement under which the Company borrowed $100 million.

Term Loan and Interest Rate Cap

In December 2004, the Company borrowed $100 million through a term loan facility dated December 3, 2004. A small portion of the

proceeds of the term loan facility were used to purchase shares tendered pursuant to the Company’s tender offer and pay related fees and

expenses. The funds are available for general corporate purposes, stock repurchases and acquisitions, subject to certain limitations.

The term loan matures in four years and amortizes in an annual amount of $23.3 million in years one, two and three and $30 million in year

four, payable in quarterly installments. Any voluntarily prepayments made by the Company will reduce, on a pro-rata basis, the remaining

outstanding amortization payments. The Company has the option to maintain the term loan as either base rate loans or Eurodollar loans, but at no

time shall there be outstanding more than four Eurodollar loans. Interest on the loans outstanding under the term loan facility will be payable, at

the Company’s option, at (a) a base rate equal to the higher of (i) the prime rate plus a margin of 2% and (ii) 0.50% in excess of the overnight

federal funds rate plus a

F- 26

Year Ending

December 31,

2006

$

15,922

2007

10,268

2008

7,211

2009

6,395

2010

4,862

Thereafter

14,680

Total

$

59,338

December 31,

2005

2004

Employee compensation and related expenses

$

20,353

$

11,459

Income taxes payable

9,769

1,119

Subscriber referral fees

4,281

4,281

Other

1,846

1,461

Total

$

36,249

$

18,320