Classmates.com 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

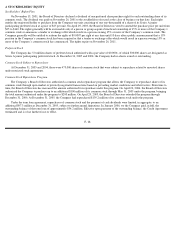

The Company will be required to determine the transition method to be used at the date of adoption. The allowed transition methods are the

modified prospective application and the modified retrospective application. Under the modified prospective application, this statement applies

to new awards and to awards modified, repurchased, or cancelled after the required effective date. Additionally, compensation cost for the

portion of awards for which the requisite service has not been rendered that are outstanding as of the required effective date will be recognized as

the requisite service is rendered on or after the required effective date. The compensation cost for that portion of awards shall be based on the

grant-date fair value of those awards as calculated for either recognition or pro forma disclosures under SFAS No. 123. The modified

retrospective application requires companies to record compensation expense for all unvested stock options and restricted stock beginning with

the first disclosed period restated. At the required effective date, the Company will apply this statement using the modified prospective

application.

The Company has selected the Black-Scholes option-pricing model as the most appropriate fair-value method for its awards and will

recognize compensation cost on an accelerated basis over the awards’ vesting periods in accordance with FIN 28. SFAS No. 123R becomes

effective in the March 2006 quarter, and the Company expects that the adoption of SFAS No. 123R will have a material impact on the

Company’s operating income, net income and earnings per share. However, uncertainties, including the Company’s future stock-based

compensation strategy, stock price volatility, estimated forfeitures and employee stock option exercise behavior, make it difficult to determine

whether the stock-based compensation expense that the Company will incur in future periods will be similar to the SFAS No. 123 pro forma

expense disclosed in Note 1. In addition, the amount of stock-

based compensation expense to be incurred in future periods will be reduced by the

acceleration of certain unvested and “out-of-the-money” stock options in December 2005 as disclosed in Note 8.

In March 2005, the SEC issued SAB No. 107, Share-Based Payment . The interpretations in this SAB express views of the staff regarding

the interaction between SFAS No. 123R and certain SEC rules and regulations and provide the staff’s views regarding the valuation of share-

based payment arrangements for public companies. In particular, this SAB provides guidance related to share-based payment transactions with

non employees, the transition from nonpublic to public entity status, valuation methods (including assumptions such as expected volatility and

expected term), the accounting for certain redeemable financial instruments issued under share-

based payment arrangements, the classification of

compensation expense, non-GAAP financial measures, capitalization of compensation cost related to share-based payment arrangements, the

accounting for income tax effects of share-based payment arrangements upon adoption of SFAS No. 123R, the modification of employee share

options prior to adoption of SFAS No. 123R and disclosures in Management’s Discussion and Analysis (“MD&A”) subsequent to adoption of

SFAS No. 123R.

In June 2005, the FASB issued SFAS No. 154, Accounting Changes and Error Corrections—a replacement of APB Opinion No. 20 and

FASB Statement No. 3

. SFAS No. 154 changes the requirements for the accounting for and reporting of a change in accounting principle and

applies to all voluntary changes in accounting principle. APB Opinion No. 20 previously required that most voluntary changes in accounting

principle be recognized by including in net income of the period of change the cumulative effect of changing to the new accounting principle.

SFAS No. 154 requires retrospective application to prior periods’ financial statements of changes in accounting principle, unless it is

impracticable to determine either the period-specific effects or the cumulative effect of the change. When it is impracticable to determine the

period-specific effects of an accounting change on one or more individual prior periods presented, SFAS No. 154 requires that the new

accounting principle be applied to the balances of assets and liabilities as of the beginning of the earliest period for which retrospective

application is practicable and that a corresponding adjustment be made to the opening balance of retained earnings for that period rather than

being reported in an income statement. When it is impracticable to determine the cumulative effect of applying a change in accounting principle

to all prior periods, SFAS No. 154 requires that the new

F- 19