Classmates.com 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

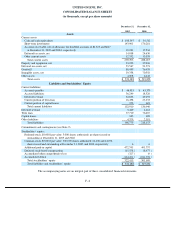

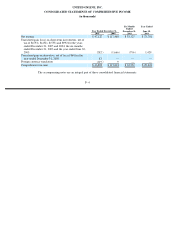

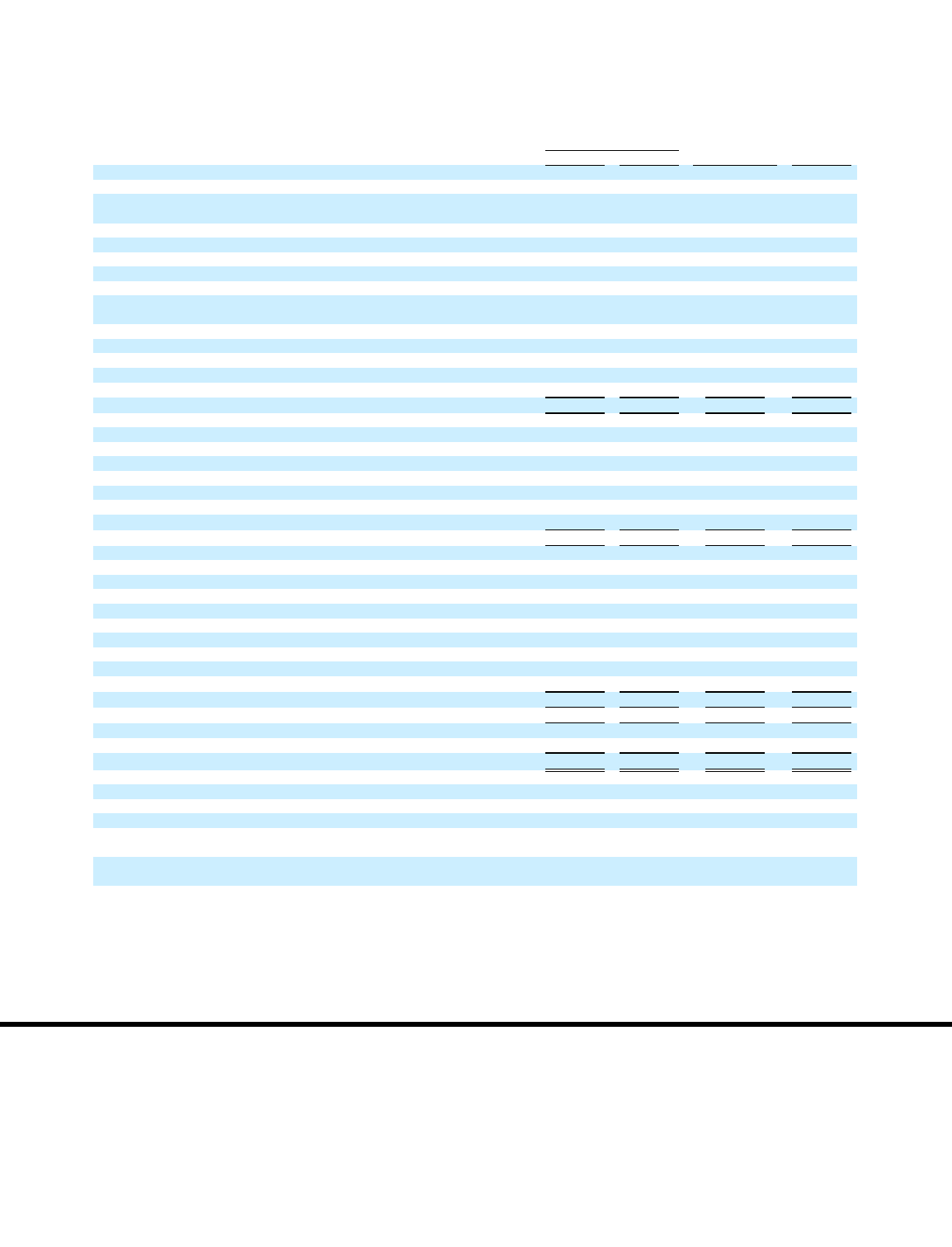

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

The accompanying notes are an integral part of these consolidated financial statements.

F- 9

Year Ended

December 31,

Six Months

Ended

December 31,

Year

Ended

June 30,

2005

2004

2003

2003

Cash flows from operating activities:

Net income

$

47,127

$

117,480

$

33,327

$

27,792

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization

37,280

29,151

11,076

27,560

Stock

-

based compensation

9,952

2,449

—

107

Deferred taxes

1,577

(61,478

)

(5,632

)

(4,336

)

Tax benefits from stock options

15,170

25,156

7,000

1,464

Other

748

1,005

621

866

Changes in operating assets and liabilities (excluding the effects of

acquisitions):

Accounts receivable

(1,669

)

220

(1,645

)

(2,832

)

Other assets

1,806

(4,122

)

(3,180

)

4,050

Accounts payable and accrued liabilities

17,677

11,356

5,302

6,678

Deferred revenue

5,181

848

1,023

3,757

Other liabilities

2,198

1,895

—

—

Net cash provided by operating activities

137,047

123,960

47,892

65,106

Cash flows from investing activities:

Purchases of property and equipment

(21,653

)

(12,510

)

(5,075

)

(5,983

)

Purchases of rights, patents and trademarks

(5,562

)

(926

)

—

—

Purchases of short

-

term investments

(320,869

)

(329,083

)

(228,941

)

(141,422

)

Proceeds from maturities and sales of short

-

term investments

353,333

344,519

208,130

75,400

Proceeds from sales of assets, net

—

92

—

—

Proceeds from sale of cost

-

basis investment

—

—

—

750

Cash paid for acquisitions, net of cash acquired

(8,638

)

(110,102

)

—

(

8,388

)

Net cash used for investing activities

(3,389

)

(108,010

)

(25,886

)

(79,643

)

Cash flows from financing activities:

Payments on capital leases

(621

)

(166

)

(34

)

(2,968

)

Proceeds from term loan and line of credit, net

—

107,569

—

—

Payments on term loan

(45,792

)

—

—

—

Repayment of line of credit

—

(

10,300

)

—

—

Repayment of notes receivable from stockholders

—

—

—

1,653

Payments for dividends

(38,067

)

—

—

—

Proceeds from exercises of stock options

5,874

6,015

8,971

6,962

Proceeds from employee stock purchase plan

3,169

3,045

1,679

1,862

Repurchases of common stock and option shares exercised

(14,206

)

(74,509

)

(40,002

)

(7,777

)

Net cash provided by (used for) financing activities

(89,643

)

31,654

(29,386

)

(268

)

Effect of exchange rate changes on cash and cash equivalents

(130

)

—

—

—

Change in cash and cash equivalents

43,885

47,604

(7,380

)

(14,805

)

Cash and cash equivalents, beginning of period

56,512

8,908

16,288

31,093

Cash and cash equivalents, end of period

$

100,397

$

56,512

$

8,908

$

16,288

Supplemental disclosure of cash flows:

Cash paid for interest

$

4,245

$

9

$

1

$

86

Cash paid for income taxes

13,970

2,851

250

225

Supplemental disclosure of non

-

cash investing and financing activities:

Stock option tax benefits recognized in connection with the release of the deferred

tax valuation allowance

$

—

$

—

$

15,006

$

3,720

Reduction in goodwill and intangibles in connection with the release of the

deferred tax valuation allowance

—

20,782

1,399

—

Issuance of common stock and options assumed for acquisitions

—

2,880

—

—