Classmates.com 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

margin of 2% or (b) at a eurodollar rate generally equal to LIBOR with a maturity comparable to a selected interest period, plus a margin of 3%.

The Company may make optional prepayments of the term loan, in whole or in part (subject to a minimum prepayment amount), without

premium or penalty, and subject to the reimbursement of lenders’ customary breakage costs in the case of a prepayment of Eurodollar

borrowings. Subject to certain limitations, the Company is required to make prepayments of a portion of the term loan from excess cash flow

(commencing in the first quarter of 2006), proceeds of asset sales, insurance recovery and condemnation events and the issuance of equity and

debt. During the year ended December 31, 2005, the Company made voluntary prepayments of $28.8 million on the term loan which reduced

future principal repayments on a pro rata basis.

The facility is collateralized by substantially all of the Company’s assets and is unconditionally guaranteed by each of the Company’s

domestic subsidiaries.

The credit agreement contains certain financial and other covenants that place restrictions on additional indebtedness by the Company, liens

against the Company’s assets, payment of dividends, consolidation, merger, purchase or sale of assets, capital expenditures, investments and

acquisitions. At December 31, 2005, the Company was in compliance with all covenants.

The credit agreement also includes certain customary events of default such as payment defaults, cross defaults to other indebtedness,

bankruptcy and insolvency, and a change in control, the occurrence of which would cause all amounts under the agreement to become

immediately due and payable. At December 31, 2005, no events of default had occurred.

On January 31, 2005, the Company purchased an interest-rate cap to reduce the variability in the amount of expected future cash interest

payments that are attributable to LIBOR-based market interest rates. The interest-rate cap is designated and qualifies as a cash flow hedge. The

Company paid a $0.2 million premium to enter into the cap, which provides protection through January 31, 2007 on $25 million of the

Company’s outstanding term loan balance. The cap protects the Company from an increase in three month LIBOR over 3.5% on $25 million of

borrowings over a two-year term. Changes in the fair value of the effective portion of the cap are recognized in accumulated other

comprehensive income. Should the cap become ineffective as a hedge, gains and losses would be recognized in the results of operations in that

period. The Company recognized an unrealized gain of approximately $0.1 million in accumulated other comprehensive income during the year

ended December 31, 2005 related to the effective portion of the cash flow hedge as the cap was considered perfectly effective during the year

ended December 31, 2005. Amounts in accumulated other comprehensive income will be reclassified into earnings in the same periods during

which the future hedged cash interest payments affect earnings.

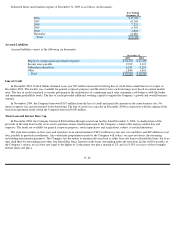

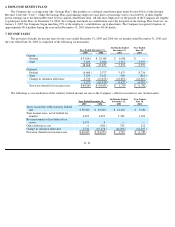

Future minimum principal payments on the term loan are as follows at December 31, 2005 (in thousands):

In January 2006, the Company paid, in full, the outstanding balance on the term loan of approximately $54.2 million. Effective upon

payment of the outstanding balance, the Credit Agreement terminated and is of no further force or effect. In connection with the repayment of

the term loan in January 2006, we sold the interest rate cap.

F- 27

Year Ending

December 31,

2006

$

16,498

2007

16,498

2008

21,212

Total

$

54,208