Classmates.com 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

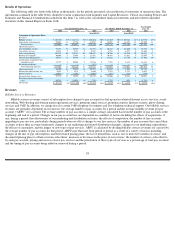

Amortization of Intangible Assets

Amortization of intangible assets includes amortization of acquired pay accounts and free accounts, acquired trademarks and trade names,

purchased technologies and other identifiable intangible assets. At December 31, 2005, we had approximately $59.3 million in net identifiable

intangible assets resulting primarily from the acquisitions of Classmates, BlueLight Internet assets and the Web-hosting and PhotoSite

businesses. At December 31, 2005, we had approximately $80.5 million in goodwill resulting from the acquisitions of Classmates and the Web-

hosting and PhotoSite businesses. In accordance with the provisions set forth in SFAS No. 142, Goodwill and Other Intangible Assets , goodwill

is not being amortized but is tested for impairment at a reporting unit level on an annual basis and between annual tests if an event occurs or

circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value amount.

Amortization of intangible assets increased by $1.4 million, or 7%, to $21.8 million for the year ended December 31, 2005, compared to

$20.4 million for the year ended December 31, 2004. The increases are due to the amortization of identifiable intangible assets from our

acquisitions of Classmates and the PhotoSite business, offset partially by a decrease in amortization of intangible assets from the Merger. We

recorded a reduction in the remaining intangible assets from the Merger of approximately $11.2 million during the December 2004 quarter in

connection with the release of the deferred tax valuation allowance. In addition, the increase was related to the amortization of identifiable

intangible assets throughout 2005 from the acquisition of our Web-hosting business in April 2004. Certain of the acquired intangible assets are

amortized on an accelerated basis to better match the expense to the expected cash flows from those assets.

Interest and Other Income, Net

Interest income consists of earnings on our cash, cash equivalents and short-term investments. Other income and expense, net consists of

realized gains and losses recognized in connection with the sale of short-term investments. Interest and other income, net increased by

$1.7 million, or 34%, to $6.9 million for the year ended December 31, 2005, compared to $5.1 million for the year ended December 31, 2004 as

a result of higher interest rates and higher average balances on our cash and cash equivalents and short-term investments. Net realized gains on

our short-term investments were not significant for the year ended December 31, 2005. Net realized gains on our short-term investments were

approximately $0.1 million for the year ended December 31, 2004.

Interest Expense

Interest expense consists of interest expense on our term loan, capital leases and the amortization of premiums on certain of our short-term

investments. Interest expense increased by $4.9 million to $6.1 million for the year ended December 31, 2005, compared to $1.2 million for the

year ended December 31, 2004. The increase was primarily the result of interest on the outstanding balance on the term loan, which was issued

in December 2004. In January 2006, we repaid the remaining balance of $54.2 million on the term loan. As a result, we anticipate a significant

decrease in interest expense in 2006.

Provision for Income Taxes

For the year ended December 31, 2005, we recorded a tax provision of $40.2 million on pre-tax income of $87.4 million, resulting in an

effective tax rate of 46.1%. The effective tax rate differs from the statutory rate primarily due to compensation, including stock-based

compensation, that was limited under Section 162(m) of the Internal Revenue Code (the “Code”); foreign losses, the benefit of which is not

currently recognizable due to uncertainty regarding realization; and the re-measurement of net deferred tax assets, including a change in New

York State tax law. This re-measurement resulted in an increase to the tax provision for the year ended December 31, 2005 by approximately

$2.5 million, or 2.8%.

44