Classmates.com 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

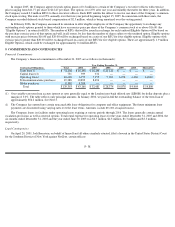

and reserved for issuance. Under the ESPP, each eligible employee may authorize payroll deductions of up to 15% of their compensation to

purchase shares of common stock on two “purchase dates” each year at a purchase price per share equal to 85% of the lower of (i) the closing

selling price per share of common stock on the employee’s entry date into the two-year offering period in which the purchase date occurs or

(ii) the closing selling price per share on the purchase date. Each offering period has a twenty-four month duration and purchase intervals of six

months.

During the years ended December 31, 2005 and 2004, the six months ended December 31, 2003 and the year ended June 30, 2003,

approximately 0.4 million, 0.4 million, 0.5 million and 0.9 million shares were purchased under the Company’s ESPP at weighted average

purchase prices of $7.46, $7.98, $3.16 and $1.99 per share, respectively. At December 31, 2005, there were approximately 2.3 million shares

available for future issuance. The weighted average fair value of ESPP shares purchased during the years ended December 31, 2005 and 2004,

the six months ended December 31, 2003 and the year ended June 30, 2003 were $3.54, $6.38, $2.21 and $1.29 per share, respectively.

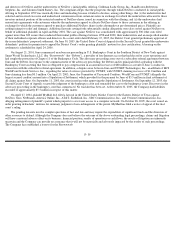

Equity Awards

In January 2004, the Board of Directors issued 575,000 restricted shares of common stock at par value to certain of the Company’s

executive officers. The shares vest entirely at the end of the four-year period from the date of grant. In connection with these shares, the

Company recorded deferred stock-based compensation of $11.4 million, which is being amortized on a straight-line basis over the four-year

vesting period. In December 2004, the Company repurchased 100,000 restricted shares of common stock in connection with the resignation of an

executive officer. In connection with the repurchase, the Company reversed $2.0 million in deferred stock-based compensation.

In January 2004, the Compensation Committee of the Board of Directors approved stock option grants of 1.2 million shares to the

Company’s executive officers. The shares are immediately exercisable, vest over a three-year period from the date of grant and have an exercise

price of $18.70.

In January 2004, the Compensation Committee of the Board of Directors approved stock option grants of 0.1 million shares to the members

of the Board. The shares are immediately exercisable, vest monthly over a one-year period from the date of grant and have an exercise price of

$18.70.

In March 2005, the Company issued approximately 1.0 million RSUs to certain of the Company’s executive officers. Each RSU entitles the

officer to receive one share of the Company’s common stock upon vesting. The units vest 25% annually over the four-year period beginning

February 15, 2005. In connection with these units, the Company recorded deferred stock-based compensation of $11.0 million, which is being

amortized over the vesting period.

In March 2005, the Company issued approximately 0.4 million additional RSUs to its other employees. Each RSU entitles the employee to

receive one share of the Company’s common stock upon vesting. The units vest 25% on February 15, 2006 and quarterly thereafter for three

years. In connection with these units, the Company recorded deferred stock

-based compensation of $3.7 million, which is being amortized over

the vesting period.

In March 2005, the Company approved stock option grants of 1.3 million shares to the Company’s employees with exercise prices ranging

from $10.55 per share to $10.58 per share. The options vest 25% on February 15, 2006 and monthly thereafter for three years.

In April 2005, the Company issued 37,500 RSUs to members of its Board of Directors. Each RSU entitles the Board member to receive one

share of the Company’s common stock upon vesting. The units vest 100% on February 15, 2006. In connection with these units, the Company

recorded deferred stock-based compensation of approximately $0.3 million, which is being amortized over the vesting period.

F- 37