Classmates.com 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

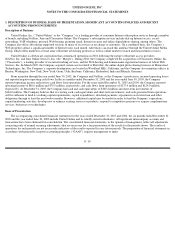

The judgments made in determining the estimated fair value and expected useful lives assigned to each class of assets and liabilities

acquired can significantly impact net income. Consequently, to the extent an indefinite-lived or a longer-lived asset is ascribed greater value

under the purchase method than a shorter-lived asset, there may be less amortization recorded in a given period. Definite-lived identifiable

intangible assets are amortized on either a straight-line basis or an accelerated basis. The Company determines the appropriate amortization

method by performing an analysis of expected cash flows over the expected useful life of the asset and matches the amortization expense to the

expected cash flows from those assets.

Determining the fair value of certain assets and liabilities acquired is subjective in nature and often involves the use of significant estimates

and assumptions. Two areas, in particular, that require significant judgment are estimating the fair value and related useful lives of identifiable

intangible assets. To assist in this process, the Company may obtain appraisals from valuation specialists for certain intangible assets. While

there are a number of different methods used in estimating the value of acquired intangibles, there are two approaches primarily used: the

discounted cash flow and market comparison approaches. Some of the more significant estimates and assumptions inherent in the two

approaches include: projected future cash flows (including timing); discount rate reflecting the risk inherent in the future cash flows; perpetual

growth rate; subscriber churn and terminal value; determination of appropriate market comparables; and the determination of whether a premium

or a discount should be applied to comparables. Most of the above assumptions are made based on available historical information.

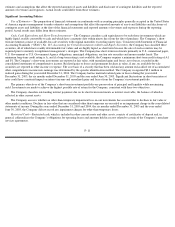

Revenue Recognition— The Company applies the provisions of Securities and Exchange Commission (“SEC”) Staff Accounting Bulletin

(“SAB”) No. 104, Revenue Recognition in Financial Statements, which provides guidance on the recognition, presentation and disclosure of

revenue in financial statements filed with the SEC. SAB No. 104 outlines the basic criteria that must be met to recognize revenue and provides

guidance for disclosure related to revenue recognition policies. In general, the Company recognizes revenue related to its billable services and

advertising products when (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred or services have been rendered, (iii) the fee

is fixed or determinable and (iv) collectibility is reasonably assured. The Company also applies the provisions of Emerging Issues Task Force

(“EITF”) Issue No. 00-21, Revenue Arrangements with Multiple Deliverables .

Billable services revenues are recognized in the period in which fees are fixed or determinable and the related products or services are

provided to the user. The Company’s pay account users generally pay in advance for their service by credit card, and revenue is then recognized

ratably over the period in which the related services are provided. Advance payments from users are recorded on the balance sheet as deferred

revenue. The Company offers alternative payment methods to credit cards for certain pay service plans. These alternative payment methods

currently include electronic check payment, payment by personal check or money order or through a local telephone company. In circumstances

where payment is not received in advance, revenue is only recognized if collectibility is reasonably assured.

Advertising and commerce revenues consist primarily of fees from Internet search partners that are generated as a result of users utilizing

partner Internet search services, fees generated by users viewing and clicking on third-party Web site banners and text-link advertisements, fees

generated by enabling customer registrations for partners and fees from referring users to, or from users making purchases on, sponsors’ Web

sites. Revenues are recognized provided that no significant obligations remain, fees are fixed or determinable, and collection of the related

receivable is reasonably assured. The Company recognizes banner advertising and sponsorship revenues in the periods in which the

advertisement or sponsorship placement is displayed, based upon the lesser of (i) impressions delivered divided by the total number of

guaranteed impressions or (ii) ratably over the period in which the advertisement is displayed. The Company’s obligations typically include a

minimum number of impressions or the satisfaction of other performance criteria. Revenue from performance-based arrangements, including

referral revenues, is recognized as the related performance criteria are met. In determining whether an arrangement exists, the

F- 14