Classmates.com 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accounting principle be applied as if it were adopted prospectively from the earliest date practicable. In addition, SFAS No. 154 makes a

distinction between retrospective application of an accounting principle and the restatement of financial statements to reflect the correction of an

error. SFAS No. 154 is effective for accounting changes and corrections of errors made beginning in the March 2006 quarter. The Company does

not expect the implementation of SFAS No. 154 to have a material impact on the Company’s financial position, results of operations or cash

flows.

2. ACQUISITIONS

PhotoSite

In March 2005, the Company acquired certain assets related to PhotoSite, the online digital photo-sharing business of Homestead

Technologies, Inc., for approximately $10.1 million in cash, including acquisition costs, and entered into a related licensing and support

agreement with Homestead Technologies. Included in the purchase price of $10.1 million is a $1.5 million payment due in March 2006, which is

included in accrued liabilities at December 31, 2005. The acquisition was accounted for under the purchase method in accordance with SFAS

No. 141,

Business Combinations . The primary reason for the acquisition was to acquire PhotoSite’s software and services to expand the

Company’s subscription offerings.

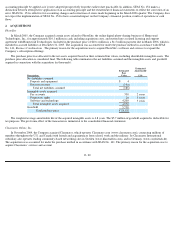

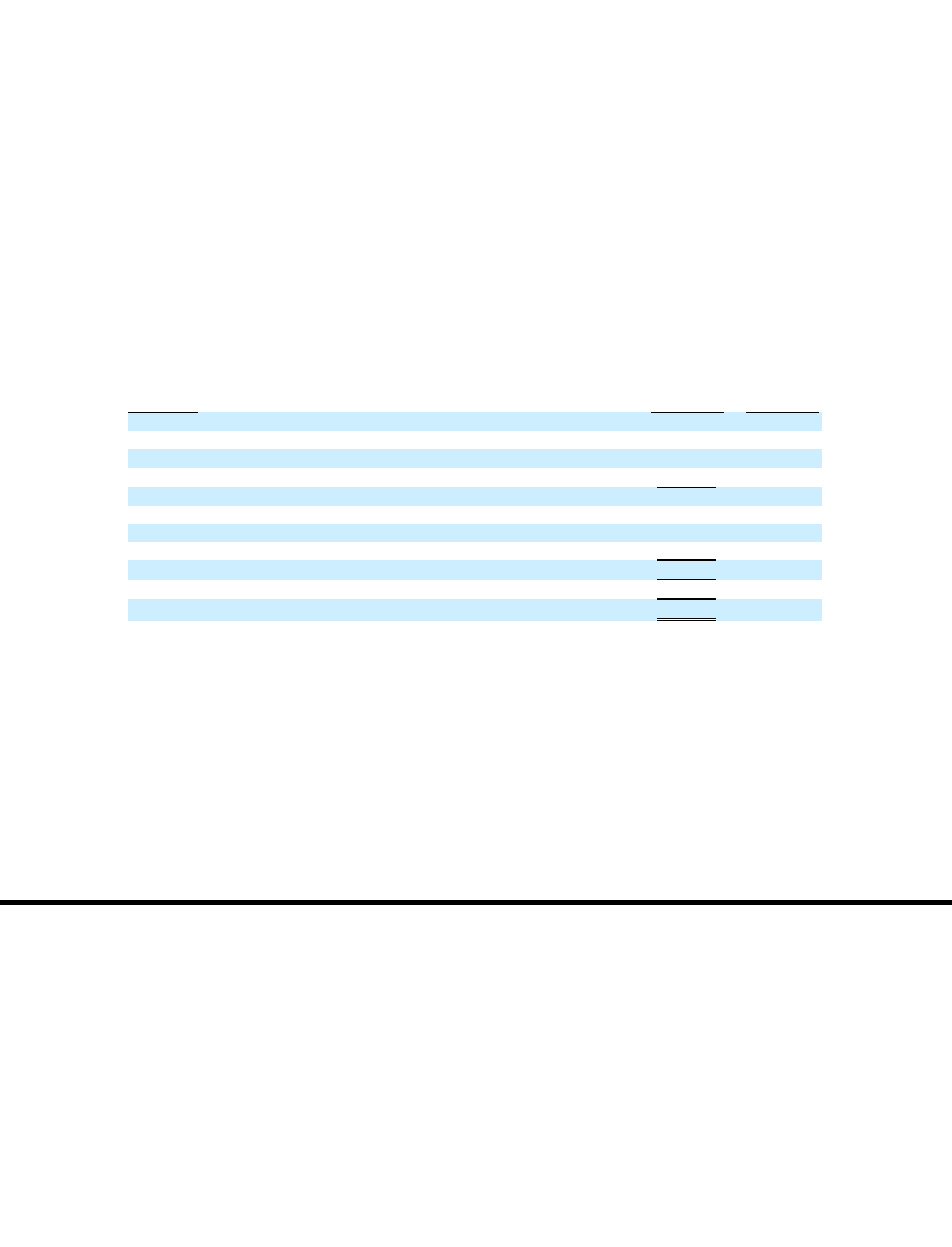

The purchase price was allocated to the net assets acquired based on their estimated fair values, including identifiable intangible assets. The

purchase price allocation is considered final. The following table summarizes the net liabilities assumed and the intangible assets and goodwill

acquired in connection with the acquisition (in thousands):

The weighted average amortizable life of the acquired intangible assets is 4.8 years. The $5.7 million of goodwill acquired is deductible for

tax purposes. The pro forma effect of the transaction is immaterial to the consolidated financial statements.

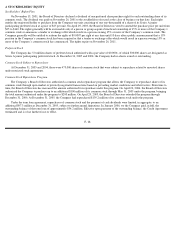

Classmates Online, Inc.

In November 2004, the Company acquired Classmates, which operates Classmates.com (www.classmates.com), connecting millions of

members throughout the U.S. and Canada with friends and acquaintances from school, work and the military. Its Classmates International

subsidiary also operates leading community-based networking sites in Sweden (www.klasstraffen.com), and in Germany (www.stayfriends.de).

The acquisition was accounted for under the purchase method in accordance with SFAS No. 141. The primary reason for the acquisition was to

acquire Classmates’ services and account

F- 20

Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Net liabilities assumed:

Property and equipment

$

4

Deferred revenue

(190

)

Total net liabilities assumed

(186

)

Intangible assets acquired:

Pay accounts

330

2 years

Proprietary rights

20

5 years

Software and technology

4,200

5 years

Total intangible assets acquired

4,550

Goodwill

5,738

Total purchase price

$

10,102