Classmates.com 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

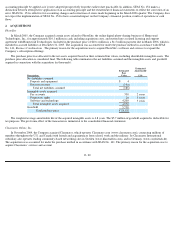

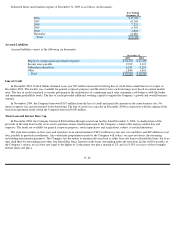

The purchase price of approximately $8.4 million, including $0.1 million of acquisition-related costs, was paid in cash and allocated to the

assets acquired based on their estimated fair values, including identifiable intangible assets. The following table summarizes the net assets and

intangible assets acquired in connection with the acquisition (in thousands):

The weighted average amortizable life of acquired intangible assets is 3.9 years. The pro forma effect of the transaction is immaterial to the

consolidated financial statements.

3. BALANCE SHEET COMPONENTS

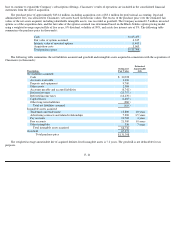

Short-Term Investments

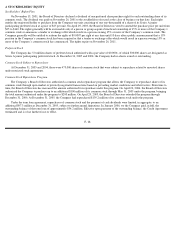

Short-term investments consist of the following (in thousands):

Gross unrealized gains and losses are presented net of tax in accumulated other comprehensive income on the consolidated balance sheets.

The Company recognized $0.1 million of realized gains from the sale of short-term investments in the year ended December 31, 2004. The

Company had no material realized gains or losses from the sale of short-term investments in the year ended December 31, 2005, six months

ended December 31, 2003 and the year ended June 30, 2003.

F- 23

Description

Estimated

Fair Value

Estimated

Amortizable

Life

Net tangible assets acquired:

Accounts receivable

$

1,611

Property and equipment

585

Accounts payable

(649

)

Deferred service liabilities

(1,044

)

Total net tangible assets acquired

503

Intangible assets acquired:

Pay accounts

7,500

4 years

Proprietary rights

235

3 years

Software and technology

150

2.5 years

Total intangible assets acquired

7,885

Total purchase price

$

8,388

December 31, 2005

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

U.S. corporate notes

$

28,143

$

3

$

(10

)

$

28,136

Government agencies

116,321

—

(

492

)

115,829

Total

$

144,464

$

3

$

(502

)

$

143,965

December 31, 2004

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

U.S. corporate notes

$

10,055

$

110

$

—

$

10,165

Government agencies

166,250

76

(210

)

166,116

Total

$

176,305

$

186

$

(210

)

$

176,281