Classmates.com 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

price offered by a potential acquirer. In addition, our board of directors adopted a stockholder rights plan, which is an anti-takeover measure that

will cause substantial dilution to a person who attempts to acquire our company on terms not approved by our board of directors.

Our stock price has been highly volatile and may continue to be volatile.

The market price of our common stock has fluctuated significantly since our stock began trading on the Nasdaq National Market in

September 2001 and it is likely to continue to be volatile with extreme volume fluctuations. In addition, the Nasdaq National Market, where most

publicly held Internet companies are traded, has experienced substantial price and volume fluctuations. These broad market and industry factors

may harm the market price of our common stock, regardless of our actual operating performance, and for this or other reasons we could suffer

significant declines in the market price of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

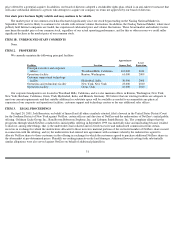

ITEM 2. PROPERTIES

We currently maintain the following principal facilities:

Our corporate headquarters are located in Woodland Hills, California, and we also maintain offices in Renton, Washington; New York,

New York; Brisbane, California; Orem, Utah; Hyderabad, India; and Munich, Germany. We believe that our existing facilities are adequate to

meet our current requirements and that suitable additional or substitute space will be available as needed to accommodate any physical

expansion of our corporate and operations facilities, customer support and technology centers or for any additional sales offices.

ITEM 3.

LEGAL PROCEEDINGS

On April 20, 2001, Jodi Bernstein, on behalf of himself and all others similarly situated, filed a lawsuit in the United States District Court

for the Southern District of New York against NetZero, certain officers and directors of NetZero and the underwriters of NetZero’s initial public

offering, Goldman Sachs Group, Inc., BancBoston Robertson Stephens, Inc. and Salomon Smith Barney, Inc. The complaint alleges that the

prospectus through which NetZero conducted its initial public offering in September 1999 was materially false and misleading because it failed

to disclose, among other things, that (i) the underwriters had solicited and received excessive and undisclosed commissions from certain

investors in exchange for which the underwriters allocated to those investors material portions of the restricted number of NetZero shares issued

in connection with the offering; and (ii) the underwriters had entered into agreements with customers whereby the underwriters agreed to

allocate NetZero shares to those customers in the offering in exchange for which the customers agreed to purchase additional NetZero shares in

the aftermarket at pre-determined prices. Plaintiffs are seeking injunctive relief and damages. Additional lawsuits setting forth substantially

similar allegations were also served against NetZero on behalf of additional plaintiffs in

31

Facilities

Location

Approximate

Square Feet

Lease

Expiration

Principal executive and corporate

offices

Woodland Hills, California

112,000

2014

Operations facility

Renton, Washington

61,000

2009

Customer support and technology

facility

Hyderabad, India

30,000

2008

Operations and technology facility

New York, New York

23,000

2010

Operations facility

Orem, Utah

16,000

2010