Classmates.com 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Concentrations of Credit and Business Risk— Financial instruments that potentially subject the Company to a concentration of credit risk

consist of cash and cash equivalents, short-term investments and accounts receivable. The Company’s accounts receivable are derived primarily

from revenue earned from pay accounts and advertising customers located in the United States. The Company extends credit based upon an

evaluation of the customer’s financial condition and, generally, collateral is not required. The Company maintains an allowance for doubtful

accounts based upon the expected collectibility of accounts receivable, and, to date, such losses have been within management’s expectations.

The Company evaluates specific accounts where information exists that the customer may have an inability to meet its financial obligations.

In these cases, based on the best available facts and circumstances, a specific reserve is recorded for that customer against amounts due to reduce

the receivable to the amount that is expected to be collected. These specific reserves are reevaluated and adjusted as additional information is

received that impacts the amount reserved. Also, a general reserve is established for all customers based on the aging of the receivables. If

circumstances change (i.e., higher than expected defaults or an unexpected material adverse change in a major customer’s ability to meet its

financial obligations), the estimates of the recoverability of amounts due to the Company could be adjusted.

At December 31, 2005, two customers comprised approximately 21% and 12% of the consolidated accounts receivable balance. At

December 31, 2004, two customers comprised approximately 18% and 14% of the consolidated accounts receivable balance. For the years ended

December 31, 2005 and 2004, the six months ended December 31, 2003 and the year ended June 30, 2003, the Company did not have any

individual customers that comprised more than 10% of total revenues.

At December 31, 2005, the majority of the Company’s cash and cash equivalents was maintained primarily with three major financial

institutions in the United States. At December 31, 2004, the majority of the Company’

s cash and cash equivalents was maintained primarily with

four major financial institutions in the United States. Deposits with these institutions generally exceed the amount of insurance provided on such

deposits.

The Company’s business depends substantially on the capacity, affordability, reliability and security of third-party telecommunications and

data service providers. Only a small number of providers offer the network services the Company requires, and the majority of its

telecommunications services is currently purchased from a limited number of vendors. A number of the Company’s historical vendors have

ceased operations or ceased offering the services that the Company requires, causing the need to switch vendors. In addition, several vendors

have experienced significant financial difficulties and filed for and emerged from bankruptcy. To the extent vendors experience future

difficulties, they may be unable to perform satisfactorily or to continue to offer their services. Any material disruption of these services could

have a material adverse effect on the Company’s financial position, results of operations and cash flows.

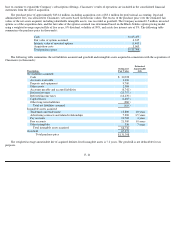

Long-Lived Assets— Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the

straight-line method over the estimated useful lives of the assets, which is generally two to three years for computer software and equipment and

three to seven years for furniture, fixtures and office equipment. Leasehold improvements are amortized over the shorter of the lease term or the

estimated useful lives. Upon the sale or retirement of property or equipment, the cost and related accumulated depreciation or amortization is

removed from the Company’s financial statements with the resulting gain or loss reflected in the Company’s results of operations. Repairs and

maintenance expenses are expensed as incurred.

Definite-lived identifiable intangible assets are amortized over their estimated useful lives, ranging from two to ten years. The Company’s

intangible assets were acquired primarily in connection with business combinations (see Note 2).

F- 12