Classmates.com 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

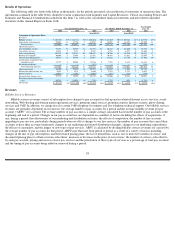

unique subscribers and, similarly, total active free accounts may not represent unique free users. In addition, a free Web-hosting account is

determined to be active if there was a visit to the site during the preceding 90 days, and it may be that the creator of the site no longer maintains

or updates the site. As such, a free Web-hosting account may not represent an ongoing relationship with the person who set up the account. At

any point in time, our pay account base includes a number of accounts receiving a free period of service as either a promotion or retention tool, a

number of accounts that have notified us that they are terminating their service but whose service is still in effect and may also include a few

thousand internal test accounts.

We have experienced declines in our pay access accounts beginning in the quarter ended June 30, 2005 and currently anticipate that our pay

access accounts will continue to decline in the future. In the quarter ended December 31, 2005, we experienced a decline in our total pay

accounts for the first time due to a decrease in pay access accounts exceeding the growth in non-access pay accounts during the quarter. In

addition, growth in non-access subscriptions was almost entirely offset by a decrease in access subscriptions and we experienced a decline in the

rate of growth in subscriptions to our accelerator services. We anticipate declines in access and accelerator subscriptions in the future. While we

anticipate limited growth in our total pay accounts during the first quarter of 2006, there can be no assurance that we will achieve such growth or

that pay accounts and subscriptions will not decline during the quarter and in the future. The dial-up Internet access market as a whole is

decreasing, and the value-priced segment is intensely competitive. We, as well as our competitors, have become more aggressive in offering

discounts and free months of service to obtain and retain dial-up subscribers. In addition, providers of broadband services have become

increasingly aggressive in discounting their services with several broadband offerings now priced at or below the prices for dial-up services, at

least for introductory periods. While we intend to continue to devote significant resources to our Internet access services, we have diversified our

business by acquiring or developing a number of non-access Internet services, including social-networking, VoIP, personal Web-hosting,

premium email and content, and online digital photo-sharing. A significant part of our strategy is to enhance and market certain of these services

as well as to expand the non-access services we offer by acquiring or developing new services. As a result, we have shifted a greater portion of

our management focus, marketing expenditures and product development initiatives away from Internet access to non-access services.

37