CarMax 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

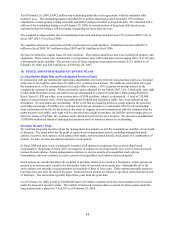

disclosures previously required by SFAS 141, better defines the acquirer and the acquisition date in a business

combination, and establishes principles for recognizing and measuring the assets acquired (including goodwill), the

liabilities assumed and any noncontrolling interests in the acquired business. SFAS 141(R) also requires an acquirer

to record an adjustment to income tax expense for changes in valuation allowances or uncertain tax positions related

to acquired businesses. SFAS 141(R) is effective for all business combinations with an acquisition date in the first

annual period following December 15, 2008; early adoption is not permitted. We will apply the provisions of SFAS

141(R) when applicable.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial

Statements—an amendment of ARB No. 51” (“SFAS 160”). SFAS 160 requires that noncontrolling (or minority)

interests in subsidiaries be reported in the equity section of our balance sheet, rather than in a mezzanine section of

the balance sheet between liabilities and equity. SFAS 160 also changes the manner in which the net income of the

subsidiary is reported and disclosed in the controlling company's income statement. SFAS 160 also establishes

guidelines for accounting for changes in ownership percentages and for deconsolidation. SFAS 160 is effective for

financial statements for fiscal years beginning on or after December 1, 2008, and interim periods within those years.

As of February 29, 2008, we did not hold any noncontrolling interests in subsidiaries.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities

– an amendment of FASB Statement No. 133” (“SFAS 161”), which expands the disclosure requirements about an

entity’ s derivative instruments and hedging activities. SFAS 161 requires that objectives for using derivative

instruments and related hedged activities be disclosed in terms of the underlying risk that the entity is intending to

manage and in terms of accounting designation. The fair values of derivative instruments and related hedged

activities and their gains are to be disclosed in tabular format showing both the derivative positions existing at

period end and the effect of using derivatives during the reporting period. Any credit-risk-related contingent

features are to be disclosed and are to include information on the potential effect on an entity’ s liquidity from using

derivatives. Finally, SFAS 161 requires cross-referencing within the notes to enable users of financial statements to

better locate information about derivative instruments. These expanded disclosure requirements are required for

every annual and interim reporting period for which a balance sheet and statement of earnings are presented. SFAS

161 is effective for fiscal years beginning after November 15, 2008, with early application encouraged. We will be

required to adopt SFAS 161 as of March 1, 2009.

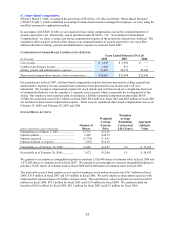

17. SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)

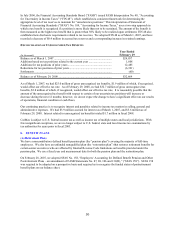

First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

(In thousands except

p

er share data) 2008 2008 2008 2008 2008

Net sales and operating

revenues................................. $ 2,147,134 $ 2,122,530 $ 1,885,300 $ 2,044,607 $ 8,199,571

Gross profit ................................ $ 284,221 $ 288,194 $ 242,883 $ 257,127 $ 1,072,425

CarMax Auto Finance

income (loss).......................... $ 37,068 $ 33,412 $ 16,347 $ (962) $ 85,865

Selling, general and

administrative expenses ........ $ 213,814 $ 214,196 $ 210,508 $ 219,854 $ 858,372

Net earnings ............................... $ 65,355 $ 64,995 $ 29,846 $ 21,829 $ 182,025

Net earnings per share:

Basic ...................................... $ 0.30 $ 0.30 $ 0.14 $ 0.10 $ 0.84

Diluted ................................... $ 0.30 $ 0.29 $ 0.14 $ 0.10 $ 0.83

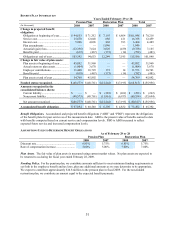

First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

(In thousands except

p

er share data) 2007 2007 2007 2007 2007

Net sales and operating

revenues................................... $ 1,885,139 $ 1,929,542 $ 1,768,147 $ 1,882,828 $ 7,465,656

Gross profit ................................ $ 248,255 $ 253,365 $ 228,609 $ 240,833 $ 971,062

CarMax Auto Finance income.. $ 32,394 $ 36,512 $ 31,974 $ 31,745 $ 132,625

Selling, general and

administrative expenses ........ $ 186,966 $ 200,049 $ 187,318 $ 201,835 $ 776,168

Net earnings ............................... $ 56,776 $ 54,264 $ 45,419 $ 42,138 $ 198,597

Net earnings per share:

Basic ...................................... $ 0.27 $ 0.26 $ 0.21 $ 0.20 $ 0.93

Diluted ................................... $ 0.27 $ 0.25 $ 0.21 $ 0.19 $ 0.92