CarMax 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

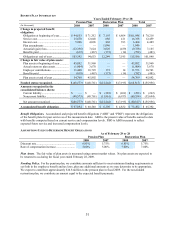

Effective March 1, 2007, changes in the funded status of our retirement plans are recognized in accumulated other

comprehensive loss. The cumulative balances are net of deferred tax of $9.8 million as of February 29, 2008, and

$11.9 million as of February 28, 2007.

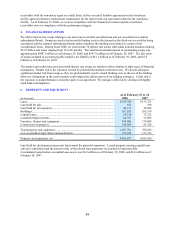

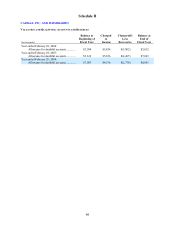

13. LEASE COMMITMENTS

We conduct a majority of our business in leased premises. Our lease obligations are based upon contractual

minimum rates. Most leases provide that we pay taxes, maintenance, insurance and operating expenses applicable to

the premises. The initial term of most real property leases will expire within the next 20 years; however, most of the

leases have options providing for renewal periods of 5 to 20 years at terms similar to the initial terms. For operating

leases, rent is recognized on a straight-line basis over the lease term, including scheduled rent increases and rent

holidays. Rent expense for all operating leases was $78.9 million in fiscal 2008, $75.4 million in fiscal 2007 and

$72.6 million in fiscal 2006.

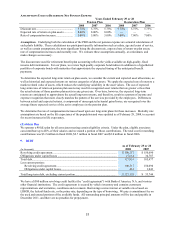

FUTURE MINIMUM LEASE OBLIGATIONS

As of February 29, 2008

Capital Operating Lease

(In thousands) Leases(1) Commitments(1)

Fiscal 2009................................................................................... $ 3,351 $ 73,542

Fiscal 2010................................................................................... 3,516 74,048

Fiscal 2011................................................................................... 3,665 74,216

Fiscal 2012................................................................................... 3,665 74,349

Fiscal 2013................................................................................... 3,665 74,537

Fiscal 2014 and thereafter............................................................ 36,786 561,040

Total minimum lease payments ................................................... $ 54,648 $ 931,732

Less amounts representing interest.............................................. (27,034)

Present value of net minimum capital lease payments..................... $ 27,614

(1) Excludes taxes, insurance and other costs payable directly by us. These costs vary from year to year and are incurred in the

ordinary course of business.

We did not enter into any sale-leaseback transactions in fiscal 2008 or 2007. We entered into sale-leaseback

transactions involving five superstores valued at approximately $72.7 million in fiscal 2006. All sale-leaseback

transactions are structured at competitive rates. Gains or losses on sale-leaseback transactions are recorded as

deferred rent and amortized over the lease term. We do not have continuing involvement under the sale-leaseback

transactions. In conjunction with certain sale-leaseback transactions, we must meet financial covenants relating to

minimum tangible net worth and minimum coverage of rent expense. We were in compliance with all such

covenants as of February 29, 2008.

14. SUPPLEMENTAL FINANCIAL STATEMENT INFORMATION

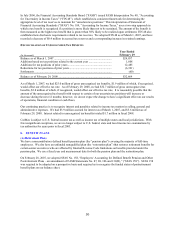

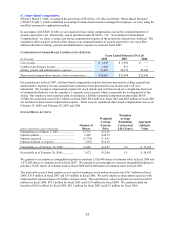

(A) Goodwill and Other Intangibles

Other assets included goodwill and other intangibles with a carrying value of $10.1 million as of February 29, 2008,

and February 28, 2007. We recognized an impairment charge of $4.9 million, included in selling, general and

administrative expenses, related to goodwill and franchise rights associated with one of our new car franchises in

fiscal 2007. No impairment of goodwill or intangible assets resulted from our annual impairment tests in fiscal 2008

or fiscal 2006.

(B) Restricted Investments

Restricted investments, included in other assets, consisted of $24.5 million in money market securities and $2.2

million in other debt securities as of February 29, 2008, and $4.9 million in money market securities and $16.8

million in other debt securities as of February 28, 2007. Proceeds from the sales of other debt securities were $33.1

million and $26.7 million for fiscal years 2008 and 2007, respectively. Due to the short-term nature and/or variable

rates associated with these financial instruments, the carrying value approximates fair value.

(C) Accrued Compensation and Benefits

Accrued expenses and other current liabilities included accrued compensation and benefits of $48.1 million as of

February 29, 2008, and $60.1 million as of February 28, 2007.