CarMax 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

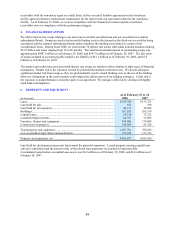

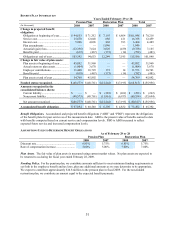

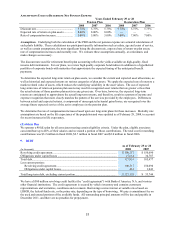

BENEFIT PLAN INFORMATION

Years Ended February 29 or 28

Pension Plan Restoration Plan Total

(In thousands) 2008 2007 2008 2007 2008 2007

Change in projected benefit

obligation:

Obligation at beginning of year............. $ 94,653 $ 71,352 $ 7,195 $ 6,864 $ 101,848 $ 78,216

Service cost ........................................... 15,670 12,048 688 411 16,358 12,459

Interest cost ........................................... 5,996 4,096 468 393 6,464 4,489

Plan amendments .................................. — — 1,046 — 1,046 —

Actuarial (gain) loss.............................. (12,358) 7,624 3,020 (459) (9,338) 7,165

Benefits paid ......................................... (619) (467) (173) (14) (792) (481)

Obligation at end of year....................... 103,342 94,653 12,244 7,195 115,586 101,848

Change in fair value of plan assets:

Plan assets at beginning of year ............ 45,892 31,960 — — 45,892 31,960

Actual return on plan assets .................. (1,904) 3,670 — — (1,904) 3,670

Employer contributions......................... 11,400 10,729 173 14 11,573 10,743

Benefits paid ......................................... (619) (467) (173) (14) (792) (481)

Plan assets at end of year ...................... 54,769 45,892 — — 54,769 45,892

Funded status recognized....................... $ (48,573) $ (48,761) $ (12,244) $ (7,195) $ (60,817) $ (55,956)

Amounts recognized in the

consolidated balance sheets:

Current liability..................................... $ — $ — $ (283) $ (262) $ (283) $ (262)

Noncurrent liability............................... (48,573) (48,761) (11,961) (6,933) (60,534) (55,694)

Net amount recognized .........................

$ (48,573) $ (48,761) $ (12,244) $ (7,195) $ (60,817) $ (55,956)

Accumulated benefit obligation............. $ 67,094 $ 60,560 $ 6,398 $ 4,832 $ 73,492 $ 65,392

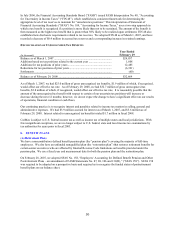

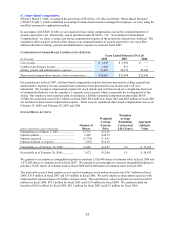

Benefit Obligations. Accumulated and projected benefit obligations (“ABO” and “PBO”) represent the obligations

of the benefit plans for past service as of the measurement date. ABO is the present value of benefits earned to date

with benefits computed based on current service and compensation levels. PBO is ABO increased to reflect

expected future service and increased compensation levels.

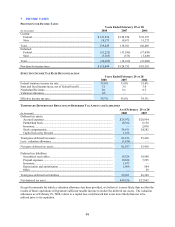

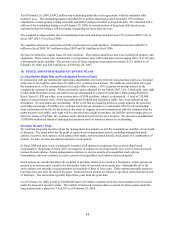

ASSUMPTIONS USED TO DETERMINE BENEFIT OBLIGATIONS

As of February 29 or 28

Pension Plan Restoration Plan

2008 2007 2008 2007

Discount rate...................................................... 6.85% 5.75% 6.85% 5.75%

Rate of compensation increase .......................... 5.00% 5.00% 7.00% 7.00%

Plan Assets. The fair value of plan assets is measured using current market values. No plan assets are expected to

be returned to us during the fiscal year ended February 28, 2009.

Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as

set forth in the employee benefit and tax laws, plus any additional amounts as we may determine to be appropriate.

We expect to contribute approximately $14.8 million to the pension plan in fiscal 2009. For the non-funded

restoration plan, we contribute an amount equal to the expected benefit payments.