CarMax 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Credit risk is the exposure to nonperformance of another party to an agreement. We mitigate credit risk by dealing

with highly rated bank counterparties. The market and credit risks associated with financial derivatives are similar

to those relating to other types of financial instruments. Note 5 provides additional information on financial

derivatives.

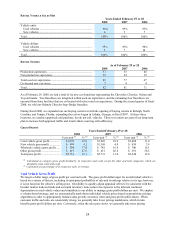

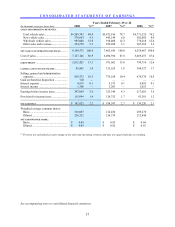

COMPOSITION OF AUTO LOAN RECEIVABLES

As of February 29 or 28

(In millions) 2008 2007

Principal amount of:

Fixed-rate securitizations ......................................................................................... $ 2,533.4 $ 2,644.1

Floating-rate securitizations synthetically altered to fixed (1)................................... 1,230.6 597.5

Floating-rate securitizations..................................................................................... 0.5 0.6

Loans held for investment (2) ................................................................................... 69.0 62.7

Loans held for sale (3) ............................................................................................... 5.0 6.2

Total............................................................................................................................. $ 3,838.5 $ 3,311.0

(1) Includes $376.7 million of variable-rate securities issued in connection with the 2007-3 and 2008-1 public securitizations that were

synthetically altered to fixed at the bankruptcy-remote special purpose entity.

(2) The majority is held by a bankruptcy-remote special purpose entity.

(3) Held by a bankruptcy-remote special purpose entity.

Interest Rate Exposure

We also have interest rate risk from changing interest rates related to our outstanding debt. Substantially all of our

debt is floating-rate debt based on LIBOR. A 100-basis point increase in market interest rates would have decreased

our fiscal 2008 net earnings per share by less than $0.01.