CarMax 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

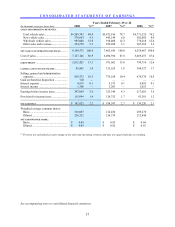

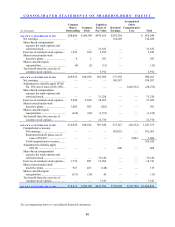

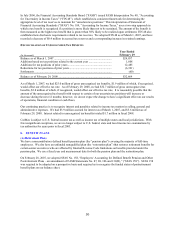

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Accumulated

Common Capital in Other

Shares Common Excess of Retained Comprehensive

(In thousands) Outstanding Stock Par Value Earnings Loss Total

BALANCE AS OF FEBRUARY 28, 2005 208,606 $104,304 $ 470,610 $ 239,330 $ 814,244

Net earnings ...................................... — — — 134,220 134,220

Share-based compensation

expense for stock options and

restricted stock............................... — — 21,632 — 21,632

Exercise of common stock options.... 1,302 650 5,295 — 5,945

Shares issued under stock

incentive plans............................... 6 2 101 — 103

Shares cancelled upon

reacquisition .................................. (4) (2) (11) — (13)

Tax benefit from the exercise of

common stock options................... — — 3,972 — 3,972

BALANCE AS OF FEBRUARY 28, 2006 209,910 104,954 501,599 373,550 980,103

Net earnings ...................................... — — — 198,597 198,597

Adjustment to initially apply SFAS

No. 158, net of taxes of $11,858.... — — — — $ (20,332) (20,332)

Share-based compensation

expense for stock options and

restricted stock............................... — — 31,526 — — 31,526

Exercise of common stock options.... 5,280 2,640 34,383 — — 37,023

Shares issued under stock

incentive plans............................... 1,002 502 (201) — — 301

Shares cancelled upon

reacquisition .................................. (164) (82) (1,531) — — (1,613)

Tax benefit from the exercise of

common stock options................... — — 21,770 — — 21,770

BALANCE AS OF FEBRUARY 28, 2007 216,028 108,014 587,546 572,147 (20,332) 1,247,375

Comprehensive income:

Net earnings................................... — — — 182,025 — 182,025

Retirement benefit plans, net of

taxes of $2,091 ......................... — — — — 3,604 3,604

Total comprehensive income......... 185,629

Adjustment to initially apply

FIN 48 ...................................... — — — 408 — 408

Share-based compensation

expense for stock options and

restricted stock............................... — — 33,146 — — 33,146

Exercise of common stock options.... 1,774 887 13,854 — — 14,741

Shares issued under stock

incentive plans............................... 927 463 (148) — — 315

Shares cancelled upon

reacquisition .................................. (113) (56) 45 — — (11)

Tax benefit from the exercise of

common stock options................... — — 7,323 — — 7,323

BALANCE AS OF FEBRUARY 29, 2008 ............. 218,616 $109,308 $641,766 $ 754,580 $ (16,728) $1,488,926

See accompanying notes to consolidated financial statements.