CarMax 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

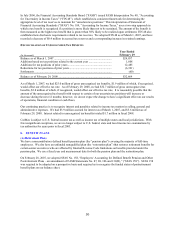

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes” (“FIN 48”), which established a consistent framework for determining the

appropriate level of tax reserves to maintain for “uncertain tax positions.” This interpretation of Statement of

Financial Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes,” uses a two-step approach in

which a tax benefit is recognized if a position is more likely than not to be sustained. The amount of the benefit is

then measured as the highest tax benefit that is greater than 50% likely to be realized upon settlement. FIN 48 also

established new disclosure requirements related to tax reserves. We adopted FIN 48 as of March 1, 2007, and have

recorded a decrease of $0.4 million in accrued tax reserves and a corresponding increase in retained earnings.

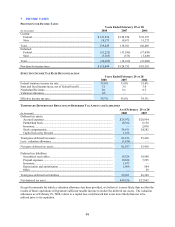

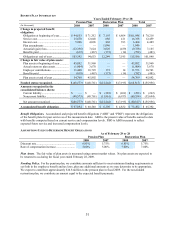

RECONCILIATION OF UNRECOGNIZED TAX BENEFITS

(In thousands)

Year Ended

February 29

Balance as of March 1, 2007 ................................................................................ $24,957

Additions based on tax positions related to the current year ................................ 1,608

Additions for tax positions of prior years ............................................................. 12,485

Reductions for tax positions of prior years........................................................... (6,321)

Settlements ........................................................................................................... (60)

Balance as of February 29, 2008 .......................................................................... $32,669

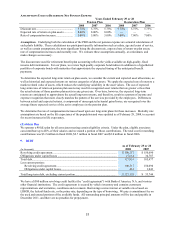

As of March 1, 2007, we had $25.0 million of gross unrecognized tax benefits, $1.9 million of which, if recognized,

would affect our effective tax rate. As of February 29, 2008, we had $32.7 million of gross unrecognized tax

benefits, $2.8 million of which, if recognized, would affect our effective tax rate. It is reasonably possible that the

amount of the unrecognized tax benefit with respect to certain of our uncertain tax positions will increase or

decrease during the next 12 months; however, we do not expect the change to have a significant effect on our results

of operations, financial condition or cash flows.

Our continuing practice is to recognize interest and penalties related to income tax matters in selling, general and

administrative expenses. We had $3.9 million accrued for interest as of March 1, 2007, and $5.6 million as of

February 29, 2008. Interest related to unrecognized tax benefits totaled $1.7 million in fiscal 2008.

CarMax is subject to U.S. federal income tax as well as income tax of multiple states and local jurisdictions. With

few insignificant exceptions, we are no longer subject to U.S. federal, state and local income tax examinations by

tax authorities for years prior to fiscal 2003.

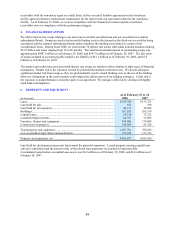

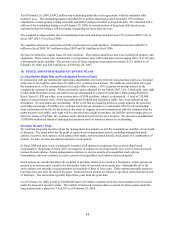

8. BENEFIT PLANS

(A) Retirement Plans

We have a noncontributory defined benefit pension plan (the “pension plan”) covering the majority of full-time

employees. We also have an unfunded nonqualified plan (the “restoration plan”) that restores retirement benefits for

certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the

pension plan. We use a fiscal year end measurement date for both the pension plan and the restoration plan.

On February 28, 2007, we adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R),” (“SFAS 158”). SFAS 158

was required to be adopted on a prospective basis and required us to recognize the funded status of postretirement

benefit plans on our balance sheet.