CarMax 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

In fiscal 2009, we also plan to expand our car-buying center test with the opening of our fourth and fifth centers, in

Dallas, Texas, (opened April 2008) and in Baltimore, Maryland. We will continue to evaluate the performance of

these five centers before deciding whether to open additional centers in future years.

We currently estimate gross capital expenditures will total approximately $350 million in fiscal 2009. Planned

expenditures primarily relate to new store construction and land purchases associated with future year store

openings, as well as the reconditioning capacity expansions. Compared with the $253 million spent in fiscal 2008,

the fiscal 2009 capital spending estimate reflects an increase in land purchases to support future year store openings

and the increase in the number of stores planned to be opened.

Fiscal 2009 Expectations

The fiscal 2009 expectations discussed below are based on historical and current trends in our business and should

be read in conjunction with “Risk Factors,” in Part I, Item 1A of this Form 10-K.

Fiscal 2009 Sales. We currently anticipate the change in comparable store used unit sales in the range of (2%) to

5% in fiscal 2009. The wide range reflects an expectation of continued softness in the economy and volatility in the

market for late-model used cars. We expect total revenues to increase between 7% and 14%, reflecting our planned

new store openings, the comparable store sales performance and anticipated declines in both used vehicle average

selling prices and new car revenues.

We are not anticipating any material change in credit availability for our customers in fiscal 2009, despite the fact

that AmeriCredit Corp. is no longer one of our third-party financing providers effective April 1, 2008. We

anticipate the majority of loans previously financed by AmeriCredit will be financed by other third-party providers.

Fiscal 2009 Earnings Per Share. We currently expect fiscal 2009 earnings per share in the range of $0.78 to $0.94.

The width of this range reflects the uncertainty of current market conditions, especially in the credit markets. We

expect to maintain our used and wholesale gross profit dollars per unit at levels similar to those in fiscal 2008.

We currently believe the CAF gain percentage on loans originated and sold in fiscal 2009 could be well below the

normalized range of 3.5% to 4.5% reflecting the continued use of a 17% discount rate in calculating the gain on

loans sold, and our expectations that funding costs and cumulative net loss rates will remain at higher-than-normal

levels due to the stresses of the current economy.

We are anticipating that the disruption in the credit markets will continue to adversely affect CAF income

throughout fiscal 2009 relative to historical norms. In addition, based on the funding cost spreads achieved in recent

comparable public securitizations, we estimate that CAF will have to absorb approximately $14 million of

incremental funding costs upon the refinancing of the $855 million that was outstanding in the warehouse facility to

the end of fiscal 2008.

Our fiscal 2009 earnings estimates also reflect an expected increase in our SG&A ratio. The combination of the

anticipated comparable store sales performance and the decline in used vehicle average selling prices, together with

continued investments supporting our growth plan, will likely cause the SG&A ratio to increase in fiscal 2009.

We expect average outstanding debt will rise in fiscal 2009, which will increase our interest expense. The higher

debt levels primarily relate to planned capital spending, as well as the prospect of continuing to retain some

subordinated bonds in connection with future CAF securitizations.

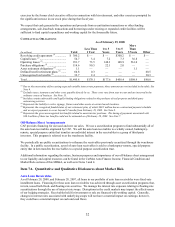

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements applicable to CarMax, see Note 16.

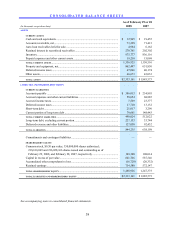

FINANCIAL CONDITION

Liquidity and Capital Resources

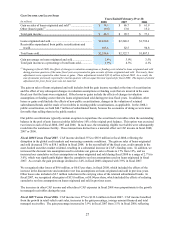

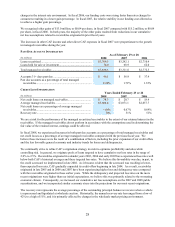

Operating Activities. We generated net cash from operating activities of $79.5 million in fiscal 2008, $136.8

million in fiscal 2007 and $117.5 million in fiscal 2006. Cash generated by operating activities was $57.3 million

lower in fiscal 2008 compared with fiscal 2007. The decrease resulted from a higher level of working capital

investment in fiscal 2008, combined with the $16.6 million decrease in net earnings. Our retained interest in

securitized receivables increased by $68.5 million in fiscal 2008 reflecting our decision to retain the $44.7 million