CarMax 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

business and the sale of extended warranties. Lastly, 10% of

gross profit came from the finance side of our business,

including CarMax Auto Finance income and the fees we

received from third-party lenders.

CarMax significantly grew gross profit per retail and

wholesale vehicle over the last several years primarily

because of improvements in buying, reconditioning and sell-

ing techniques. Determining the appropriate appraisal offer

amount and pricing our vehicles is a fine art that we con-

tinue to refine through our analytical expertise and years of

experience. Marketplace trends are reflected in the prices

we receive weekly or bi-weekly at our auctions, currently

held at 49 of our stores, and informs our appraisal offers. We

continue to attract more bidding by auto dealers at our auc-

tions by focusing on improving their experience. In addition

to third party-provided floorplan financing, a robust website and the ability to view AutoCheck vehicle histories at no

charge, we also share key information about the wholesale vehicles we sell, and sell nearly all of the vehicles we auction.

We also have initiatives underway that will help our associates reduce waste and take unnecessary costs out of our

reconditioning process. We continue to evaluate our reconditioning process, including which reconditioning activities

are most important to the customer and how to purchase and utilize supplies in the most cost-effective manner. While

we have come a long way with reconditioning process improvements, we believe there are still significant additional

opportunities to decrease costs while simultaneously improving quality.

10 | CARMAX 2008

CarMax’s unique model has yet to be successfully duplicated. Aside from our

skilled and dedicated workforce, perhaps the greatest barriers to entry by com-

petitors are our well-tested proprietary systems and processes, including our

inventory management system, our pricing models and our appraisal systems,

which we upgraded in fiscal 2008 and will continue to refine and improve.

It would be difficult for a competitor to easily or quickly replicate our

vast store of knowledge about used vehicle values gleaned from selling a total

of nearly 2.5 million vehicles at retail, wholesaling well over 1 million vehi-

cles and appraising more than 9 million vehicles since we opened our first

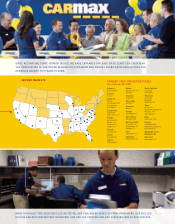

store in 1993. By the end of fiscal 2008, CarMax had successfully opened 89

used car superstores and developed experienced, knowledgeable and

engaged managers to run these and future stores.

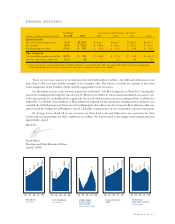

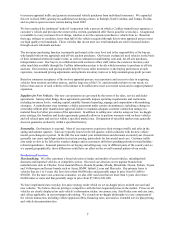

Unlike many auto retailers, CarMax has a diversified profit stream;

no competitor has its own finance and wholesale operation. Our primary busi-

ness is the retail sales of used vehicles, which drives the growth rate

of everything else we do. In fiscal 2008, the gross profit derived from retail

vehicle sales contributed approximately 63% of the sum of total gross profit

and CAF income. Additionally, approximately 15% of our gross profit came

from our wholesale business—vehicles purchased from our customers that do

not meet our retail standards and are sold to licensed dealers at our CarMax

auctions. And another 12% of gross profit was related to our vehicle service

WE BELIEVE OUR

UNIQUE BUSINESS

MODEL, PROPRIETARY

PROCESSES AND

SYSTEMS, STRONG

RESULTS AND

SOLID GROWTH

OPPORTUNITY

TOGETHER CREATE

EXCEPTIONAL LONG-

TERM VALUE FOR

SHAREHOLDERS.

RETAIL

63%

RETAIL

63%

WHOLESALE 15%

ESP/Service 12%

FINANCE 10%

DIVERSIFIED PROFIT STREAM

SHAREHOLDERS

Percentages represent breakdown of gross profit dollars

and CarMax Auto Finance income.