CarMax 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

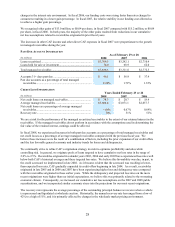

Fiscal 2007 Versus Fiscal 2006. The 11% decrease in new vehicle revenues in fiscal 2007 was substantially the

result of decreases in unit sales, and in part reflected our strategic decision in fiscal 2007 to increase targeted gross

profit dollars per unit on new vehicles. We had anticipated that this decision would result in some reduction in new

vehicle unit sales. The decline in new vehicle unit sales also reflected the effects of reduced industry new car sales

for several of the brands we represent, including Chevrolet, Chrysler and Nissan.

Wholesale Vehicle Sales

Our operating strategy is to build customer satisfaction by offering high-quality vehicles. Fewer than half of the

vehicles acquired from consumers through the appraisal purchase process meet our standards for reconditioning and

subsequent retail sale. Those vehicles that do not meet our standards are sold through on-site wholesale auctions.

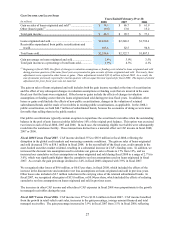

Fiscal 2008 Versus Fiscal 2007. The 7% increase in wholesale vehicle revenues in fiscal 2008 resulted from a 6%

increase in wholesale unit sales combined with a 1% increase in average wholesale selling price. Compared with the

prior year, while appraisal traffic increased, we experienced a decline in our buy rate. Our wholesale auction prices

usually reflect the trends in the general wholesale market for the types of vehicles we sell, although they may also be

affected by changes in vehicle mix or the average age, miles or condition of the vehicles wholesaled.

Fiscal 2007 Versus Fiscal 2006. The 18% increase in wholesale vehicle revenues in fiscal 2007 resulted from a

16% increase in wholesale unit sales and a 1% increase in average wholesale selling price. Our wholesale unit sales

benefited from a substantial increase in appraisal traffic, primarily spurred by our strong comparable store unit sales

growth, and the expansion of our store base. In the first half of fiscal 2007, our average wholesale selling price

climbed 6% reflecting, we believe, the residual effects of industry shortages of older, higher-mileage vehicles

experienced following Hurricanes Katrina, Rita and Wilma in the fall of 2005. In the second half of fiscal 2007, our

average wholesale selling price was 4% below the prior year level reflecting the challenging comparison with the

previous year.

Other Sales and Revenues

Other sales and revenues include commissions on the sale of ESPs, service department sales and third-party finance

fees. The fixed fees paid by third-party financing providers vary by provider, reflecting their differing levels of

credit risk exposure. We record the discount at which the subprime provider purchases loans as an offset to finance

fee revenues received from the other providers.

Fiscal 2008 Versus Fiscal 2007. Other sales and revenues increased 11% in fiscal 2008, similar to the 12%

increase in used vehicle unit sales.

Fiscal 2007 Versus Fiscal 2006. Other sales and revenues increased 10% in fiscal 2007. The increase was

primarily the result of increased sales of ESPs and an increase in third-party finance fees. The increase in ESP sales

was consistent with our increase in used vehicle unit sales. The third-party finance fees increased nearly 50% in

fiscal 2007, benefiting from the decline in sales financed by the subprime provider. Service department sales

declined modestly in fiscal 2007, as the reconditioning activities required to support our strong comparable store

used vehicle sales growth limited the service capacity available for customer pay work.

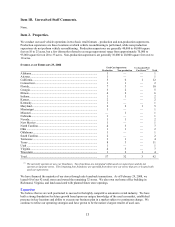

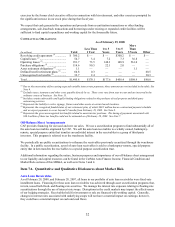

Supplemental Sales Information

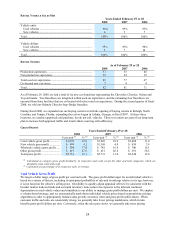

UNIT SALES

Years Ended February 29 or 28

2008 2007 2006

Used vehicles............................................................................. 377,244 337,021 289,888

New vehicles ............................................................................. 15,485 18,563 20,901

Wholesale vehicles .................................................................... 222,406 208,959 179,548

AVERAGE SELLING PRICES

Years Ended February 29 or 28

2008 2007 2006

Used vehicles............................................................................. $17,298 $ 17,249 $ 16,298

New vehicles ............................................................................. $23,795 $ 23,833 $ 23,887

Wholesale vehicles .................................................................... $ 4,319 $ 4,286 $ 4,233