CarMax 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

changes in the interest rate environment. In fiscal 2006, our funding costs were rising faster than rates charged to

consumers resulting in a lower gain percentage. In fiscal 2007, the relative stability in our funding cost allowed us

to achieve a higher gain percentage.

We recognized other gains of $13.0 million, or $0.04 per share, in fiscal 2007 compared with $15.2 million, or $0.04

per share, in fiscal 2006. In both years, the majority of the other gains resulted from reductions in our cumulative

net loss assumptions related to receivables originated in prior fiscal years.

The increases in other CAF income and other direct CAF expenses in fiscal 2007 were proportionate to the growth

in managed receivables during the year.

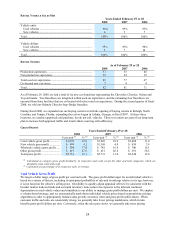

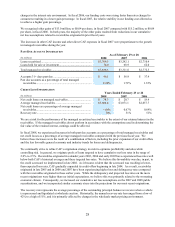

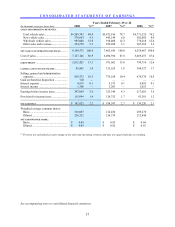

PAST DUE ACCOUNT INFORMATION

As of February 29 or 28

(In millions) 2008 2007 2006

Loans securitized ...................................................................... $ 3,764.5 $ 3,242.1 $ 2,710.4

Loans held for sale or investment............................................. 74.0 68.9 62.0

Total managed receivables ....................................................... $ 3,838.5 $ 3,311.0 $ 2,772.5

Accounts 31+ days past due ..................................................... $ 86.1 $ 56.9 $ 37.4

Past due accounts as a percentage of total managed

receivables............................................................................. 2.24% 1.72% 1.35%

CREDIT LOSS INFORMATION

Years Ended February 29 or 28

(In millions) 2008 2007 2006

Net credit losses on managed receivables................................ $ 38.3 $ 20.7 $ 18.4

Average managed receivables ................................................. $ 3,608.4 $ 3,071.1 $ 2,657.7

Net credit losses as a percentage of average managed

receivables............................................................................ 1.06% 0.67% 0.69%

Recovery rate........................................................................... 50% 51% 51%

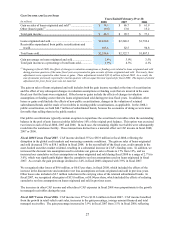

We are at risk for the performance of the managed securitized receivables to the extent of our retained interest in the

receivables. If the managed receivables do not perform in accordance with the assumptions used in determining the

fair value of the retained interest, earnings could be affected.

In fiscal 2008, we experienced increases in both past due accounts as a percentage of total managed receivables and

net credit losses as a percentage of average managed receivables compared with the previous fiscal year. We

believe these increases were the result of a combination of factors, including the prior expansion of our credit offers

and the less favorable general economic and industry trends for losses and delinquencies.

We continually strive to refine CAF’ s origination strategy in order to optimize profitability and sales while

controlling risk. In general, we originate pools of loans targeted to have cumulative net loss rates in the range of

2.0% to 2.5%. Receivables originated in calendar years 2003, 2004 and early 2005 have experienced loss rates well

below both CAF’ s historical averages and these targeted loss rates. We believe this favorability was due, in part, to

the credit scorecard we implemented in late 2002. As it became evident that the scorecard was resulting in lower-

than-expected loss rates, CAF gradually expanded its credit offers beginning in late 2004. As a result, receivables

originated in late 2005 and in 2006 and 2007 have been experiencing higher loss and delinquency rates compared

with the receivables originated in these earlier years. While the delinquency and projected loss rates on the more

recent originations were higher than our initial expectations, we believe this was primarily related to the worsening

economic climate. Consequently, we increased our cumulative net loss assumptions on the 2007 and 2008 public

securitizations, and we incorporated similar economic stress into the projections for our most recent originations.

The recovery rate represents the average percentage of the outstanding principal balance we receive when a vehicle

is repossessed and liquidated at wholesale auction. Historically, the annual recovery rate has ranged from a low of

42% to a high of 51%, and it is primarily affected by changes in the wholesale market pricing environment.