CarMax 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

(C) Share-Based Compensation

Effective March 1, 2006, we adopted the provisions of SFAS No. 123 (Revised 2004), “Share-Based Payment”

(“SFAS 123 (R)”), which established accounting for share-based awards exchanged for employee services, using the

modified retrospective application method.

In accordance with SFAS 123(R), we are required to base initial compensation cost on the estimated number of

awards expected to vest. Historically, and as permitted under SFAS No. 123, “Accounting for Stock-Based

Compensation,” we chose to reduce pro forma compensation expense in the periods the awards were forfeited. The

cumulative effect on prior periods of the change to an estimated number of awards expected to vest was a $0.6

million reduction of selling, general and administrative expenses recorded in fiscal 2007.

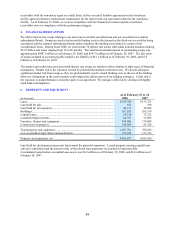

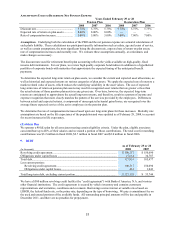

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

Years Ended February 29 or 28

(In thousands) 2008 2007 2006

Cost of sales............................................................................... $ 1,945 $ 1,392 $ —

CarMax Auto Finance income................................................... 1,250 917 —

Selling, general and administrative expenses ............................ 31,487 30,379 22,436

Share-based compensation expense, before income taxes......... $ 34,682 $ 32,688 $ 22,436

For periods prior to fiscal 2007, all share-based compensation expense has been presented in selling, general and

administrative expenses, because amounts that would have been presented in cost of sales and CAF were

immaterial. We recognize compensation expense for stock options and restricted stock on a straight-line basis (net

of estimated forfeitures) over the employee’ s requisite service period, which is generally the vesting period of the

award. Our employee stock purchase plan is considered a liability-classified compensatory plan under SFAS

123(R); the associated costs of $1.2 million in fiscal 2008, $0.9 million in fiscal 2007 and $0.8 million in fiscal 2006

are included in share-based compensation expense. There were no capitalized share-based compensation costs as of

February 29, 2008, and February 28, 2007 and 2006.

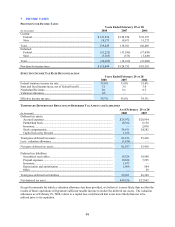

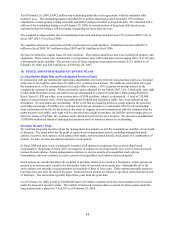

STOCK OPTION ACTIVITY

(Shares and intrinsic value in thousands)

Number of

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

Outstanding as of March 1, 2007...................... 13,775 $ 12.39

Options granted ................................................ 1,882 $ 24.72

Options exercised ............................................. (1,774) $ 8.31

Options forfeited or expired.............................. (235) $ 16.53

Outstanding as of February 29, 2008................ 13,648 $ 14.55 5.6 $ 75,425

Exercisable as of February 29, 2008................. 7,672 $ 12.00 5.1 $ 56,475

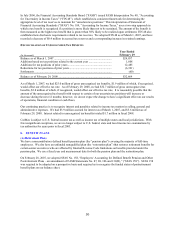

We granted to our employees nonqualified options to purchase 1,826,690 shares of common stock in fiscal 2008 and

1,837,200 shares of common stock in fiscal 2007. We granted to our nonemployee directors nonqualified options to

purchase 55,493 shares of common stock in fiscal 2008 and 68,040 shares of common stock in fiscal 2007.

The total cash received from employees as a result of employee stock option exercises was $14.7 million in fiscal

2008, $35.4 million in fiscal 2007 and $5.9 million in fiscal 2006. We settle employee stock option exercises with

authorized but unissued shares of CarMax common stock. The total intrinsic value of options exercised was $26.8

million for fiscal 2008, $74.7 million for fiscal 2007 and $13.0 million for fiscal 2006. We realized related tax

benefits of $10.6 million for fiscal 2008, $28.7 million for fiscal 2007 and $5.2 million for fiscal 2006.