CarMax 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

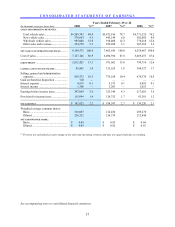

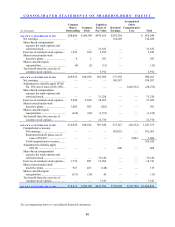

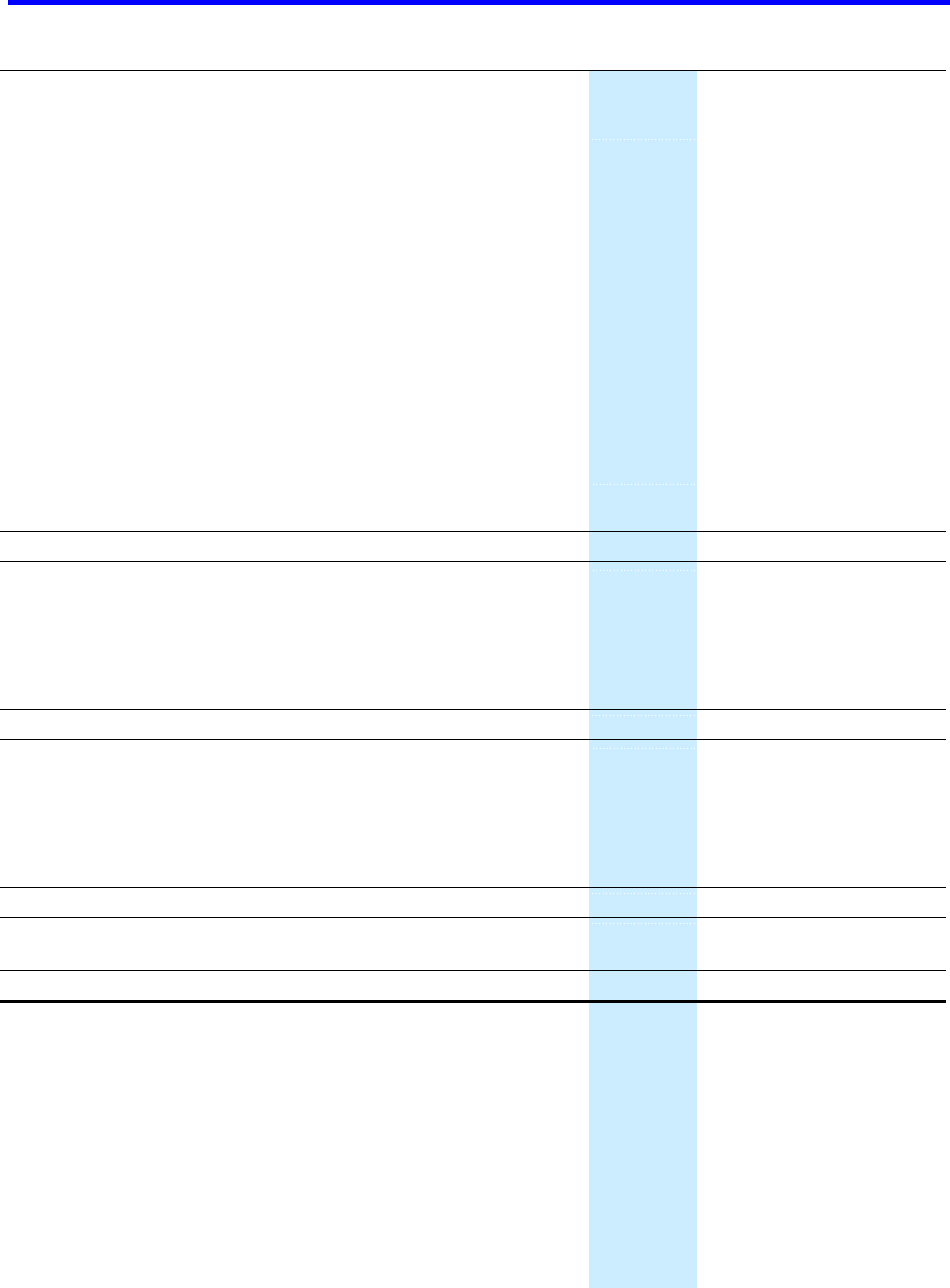

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended February 29 or 28

(In thousands) 2008 2007 2006

OPERATING ACTIVITIES:

Net earnings ..........................................................................................

.

$ 182,025 $ 198,597 $ 134,220

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation and amortization...........................................................

.

46,615 34,551 26,692

Share-based compensation expense...................................................

.

33,467 31,826 21,632

Loss (gain) on disposition of assets...................................................

.

1,404 88 (764)

Deferred income tax benefit ..............................................................

.

(24,405) (14,169) (19,088)

Impairment of long-lived assets ........................................................

.

—4,891 —

Net (increase) decrease in:

Accounts receivable, net ................................................................

.

(1,815) 5,208 (454)

Auto loan receivables held for sale, net .........................................

.

1,178 (2,023) 18,013

Retained interest in securitized receivables ...................................

.

(68,459) (43,994) (10,345)

Inventory........................................................................................

.

(139,661) (166,416) (93,133)

Prepaid expenses and other current assets .....................................

.

(4,148) (3,857) 1,797

Other assets....................................................................................

.

1,360 (3,924) (5,975)

Net increase in:

Accounts payable, accrued expenses and other current liabilities

and accrued income taxes.........................................................

.

14,561 85,633 35,133

Deferred revenue and other liabilities ............................................

.

37,398 10,389 9,785

NET CASH PROVIDED BY OPERATING ACTIVITIES..........................................

.

79,520 136,800 117,513

INVESTING ACTIVITIES:

Capital expenditures..............................................................................

.

(253,106) (191,760) (194,433)

Proceeds from sales of assets ................................................................

.

1,089 4,569 78,340

(Purchases) sales of money market securities .......................................

.

(19,565) 16,765 —

Sales of investments available-for-sale .................................................

.

21,665 4,210 —

Purchases of investments available-for-sale..........................................

.

(7,100) (20,975) —

NET CASH USED IN INVESTING ACTIVITIES ...................................................

.

(257,017) (187,191) (116,093)

FINANCING ACTIVITIES:

Increase (decrease) in short-term debt, net............................................

.

17,727 2,827 (64,734)

Issuances of long-term debt ..................................................................

.

972,300 1,232,400 701,300

Payments on long-term debt..................................................................

.

(841,119) (1,244,762) (643,364)

Equity issuances, net.............................................................................

.

14,730 35,411 6,035

Excess tax benefits from share-based payment arrangements...............

.

7,369 22,211 3,978

NET CASH PROVIDED BY FINANCING ACTIVITIES ..........................................

.

171,007 48,087 3,215

(Decrease) increase in cash and cash equivalents.....................................

.

(6,490) (2,304) 4,635

Cash and cash equivalents at beginning of year .......................................

.

19,455 21,759 17,124

CASH AND CASH EQUIVALENTS AT END OF YEAR ..............................................

.

$ 12,965 $ 19,455 $ 21,759

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid during the year for:

Interest...............................................................................................

.

$ 9,768 $ 9,768 $ 7,928

Income taxes......................................................................................

.

$ 124,868 $ 99,380 $ 94,112

Non-cash investing and financing activities:

Asset acquisitions from capitalization of leases ................................

.

$ — $ — $ 7,864

Accrued capital expenditures.............................................................

.

$ 9,909 $ — $ —

Long-term debt obligations from capitalization of leases..................

.

$ — $ — $ 7,864

Reduction of long-term debt obligations from

capitalization of leases..............................................................

.

$ 6,554 $ — $ —

Adjustment to initially apply SFAS 158, net of tax...........................

.

$ — $ 20,332 $ —

Adjustment to initially apply FIN 48.................................................

.

$ 408 $ — $ —

See accompanying notes to consolidated financial statements.