CarMax 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4| CARMAX 2008

At CarMax, one of our ongoing beliefs is that the uniqueness of our consumer offer

will help support our performance even in more challenging economic times. Fiscal

2008 was certainly one of those challenging times, as it was for many U.S. businesses.

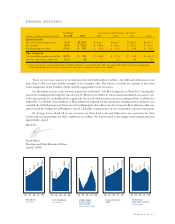

While we were disappointed that our results fell significantly below our early

expectations for the year, we were pleased nevertheless to report positive compara-

ble store used unit sales of 3%. Our basic belief is that CarMax will outperform our

competitors in most economic environments due to a variety of aspects of our con-

sumer offer. Our data indicates that we continue to gain market share in the late-model

used vehicle market.

Our fiscal 2008 results prove, however, that we are not immune to changes in

economic conditions, both from the standpoint of consumer demand and the impact

of the financial marketplace. The unprecedented and well-publicized turmoil in the

credit markets, especially for asset-backed securities, increased our funding costs, and

reduced the demand for the bonds we sell in the public securitization market. In addition, we modestly increased our

net loss assumptions, primarily due to the stresses of the current economy. As a result, profitability fell at CarMax Auto

Finance (CAF), our finance operation.

But regardless of short-term funding challenges or periodic profit shortfalls, we remain strongly committed to

CAF. Because we believe that most car buyers require financing, it is vital that CarMax provides a variety of financing

alternatives. CAF continues to be an integral part of our business, offering competitive rates to qualifying customers

that represent more than 40% of our retail unit sales. In fact, it was for just this kind of environment that we originally

Tom Folliard

President and Chief Executive Officer

CARMAX IS THE NATION’S LARGEST RETAILER OF USED CARS. OUR

CONSUMER OFFER IS STRUCTURED AROUND FOUR CUSTOMER BENEFITS:

LOW, NO-HAGGLE PRICES;A BROAD SELECTION; HIGH QUALITY VEHICLES;

AND A CUSTOMER-FRIENDLY SALES PROCESS.

LETTER TO SHAREHOLDERS

conceived of CAF, to continue to protect us and our customers with access to credit when other lenders might con-

sider tightening credit availability for reasons unrelated to our business.

During fiscal 2008, we once again achieved our annual goal of growing our superstore base by 15%. We opened

12 stores, including stores in new markets for CarMax such as Tucson, Milwaukee, Omaha and San Diego, bringing our

total used car superstores to 89 at year end. In fiscal 2009, we plan to continue investing to support our long-term growth

initiatives. We plan to open 14 superstores, entering 8 new markets and expanding our presence in 5 existing markets.

While we estimate that we have stores in locations where more than 43% of the U.S. population lives, our aver-

age market share in most of these cities is below the 8-10% we believe we have already achieved in our most mature

markets. We believe our superior business model will continue to drive the market share expansion that we expect to

achieve regardless of the external environment. This, along with expansion into new markets, represents a tremendous

future trajectory of potential growth for CarMax and our shareholders.

We plan to open two more car-buying centers in fiscal 2009. The five car-buying centers we then will have open

will represent our controlled concept test to learn whether we can achieve a meaningful increase in the percentage of

vehicles sourced directly from consumers, which currently represents more than 50% of the used vehicles we retail.

These cars are generally more profitable and also represent a superior variety of currently popular makes and models.

We will evaluate whether we are making an adequate return on our investment based on the number of incremental

retail and wholesale vehicles we are able to purchase at these centers.

We also plan to roll out a centralized reconditioning facility near Baltimore, Maryland, in fiscal 2009. In a region

as busy for us as the Baltimore-Washington, D.C. corridor, a centralized facility to recondition vehicles will support our

growth, relieve production congestion and provide further opportunity to increase efficiency in the reconditioning

process. We plan to add reconditioning capacity in the Los Angeles market, as well.