CVS 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

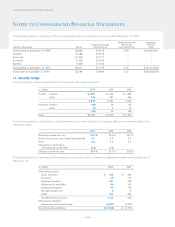

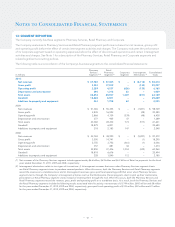

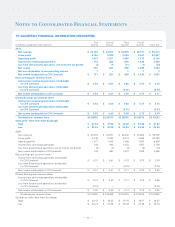

Notes to Consolidated Financial Statements

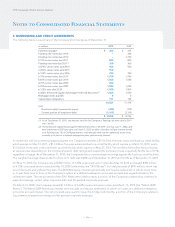

12: COMMITMENTS AND CONTINGENCIES

Between 1991 and 1997, the Company sold or spun off a number of subsidiaries, including Bob’s Stores, Linens ‘n Things,

Marshalls, Kay-Bee Toys, Wilsons, This End Up and Footstar. In many cases, when a former subsidiary leased a store, the Com-

pany provided a guarantee of the store’s lease obligations. When the subsidiaries were disposed of, the Company’s guarantees

remained in place, although each initial purchaser has indemnified the Company for any lease obligations the Company was

required to satisfy. If any of the purchasers or any of the former subsidiaries were to become insolvent and failed to make the

required payments under a store lease, the Company could be required to satisfy these obligations.

As of December 31, 2010, the Company guaranteed approximately 70 such store leases (excluding the lease guarantees related

to Linens ‘n Things, which are discussed in Note 1 previously in this document), with the maximum remaining lease term extend-

ing through 2019. Management believes the ultimate disposition of any of the remaining guarantees will not have a material

adverse effect on the Company’s consolidated financial condition, results of operations or future cash flows.

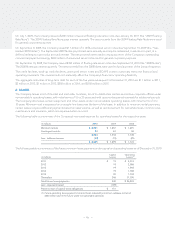

Caremark (the term “Caremark” being used herein to generally refer to any one or more of the pharmacy benefit management

subsidiaries of the Company, as applicable) is a defendant in a qui tam lawsuit initially filed by a relator on behalf of various state

and federal government agencies in Texas federal court in 1999. The case was unsealed in May 2005. The case seeks monetary

damages and alleges that Caremark’s processing of Medicaid and certain other government claims on behalf of its clients (which

allegedly resulted in underpayments from our clients to the applicable government agencies) on one of Caremark’s adjudication

platforms violates applicable federal or state false claims acts and fraud statutes. The United States and the States of Texas,

Tennessee, Florida, Arkansas, Louisiana and California intervened in the lawsuit, but Tennessee and Florida withdrew from the

lawsuit in August 2006 and May 2007, respectively. The parties previously filed cross motions for partial summary judgment, and

in August 2008, the court granted several of Caremark’s motions and denied the motions filed by the plaintiffs. The court’s rulings

are favorable to Caremark and substantially limit the ability of the plaintiffs to assert false claims act allegations or statutory or

common law theories of recovery based on Caremark’s processing of Medicaid and other government reimbursement requests.

The court’s rulings are on appeal before the United States Court of Appeals for the Fifth Circuit. In April 2009, the State of Texas

filed a purported civil enforcement action against Caremark for injunctive relief, damages and civil penalties in Travis County,

Texas alleging that Caremark violated the Texas Medicaid Fraud Prevention Act and other state laws based on our processing of

Texas Medicaid claims on behalf of PBM clients. The claims and issues raised in this lawsuit are related to the claims and issues

pending in the federal qui tam lawsuit described previously.

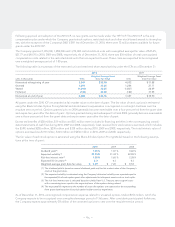

In December 2007, the Company received a document subpoena from the Office of Inspector General, United States Department

of Health and Human Services (“OIG”), requesting information relating to the processing of Medicaid and other government

agency claims on a different adjudication platform of Caremark. In October 2009 and October 2010, the Company received

civil investigative demands from the Office of the Attorney General of the State of Texas requesting, respectively, information

produced under this OIG subpoena, and other information related to the processing of Medicaid claims. The civil investigative

demands state that the Office of the Attorney General of the State of Texas is investigating allegations currently pending under

seal relating to two of Caremark’s adjudication platforms. The Company has been producing documents on a rolling basis in

response to the requests for information contained in the OIG subpoena and in these two civil investigative demands. The

Company cannot predict with certainty the timing or outcome of any review of such information.

Caremark was named in a putative class action lawsuit filed in October 2003 in Alabama state court by John Lauriello, purport-

edly on behalf of participants in the 1999 settlement of various securities class action and derivative lawsuits against Caremark

and others. Other defendants include insurance companies that provided coverage to Caremark with respect to the settled

lawsuits. The Lauriello lawsuit seeks approximately $3.2 billion in compensatory damages plus other non-specified damages

based on allegations that the amount of insurance coverage available for the settled lawsuits was misrepresented and suppressed.

A similar lawsuit was filed in November 2003 by Frank McArthur, also in Alabama state court, naming as defendants Caremark,

several insurance companies, attorneys and law firms involved in the 1999 settlement. This lawsuit was stayed as a later-filed

class action, but McArthur was subsequently allowed to intervene in the Lauriello action. The attorneys and law firms named as

defendants in McArthur’s intervention pleadings have been dismissed from the case, and discovery on class certification and

adequacy issues is underway.

– 68 –

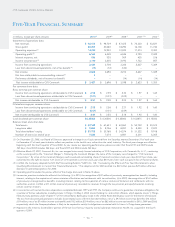

CVS Caremark 2010 Annual Report