CVS 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

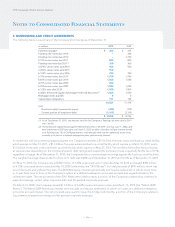

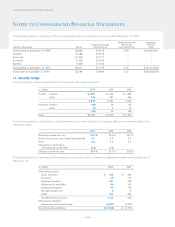

The following table is a summary of the Company’s intangible assets as of December 31:

2010 2009

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

in millions Amount Amortization Amount Amount Amortization Amount

Trademarks (indefinitely-lived) $ 6,398 $ – $ 6,398 $ 6,398 $ – $ 6,398

Customer contracts and relationships and

covenants not to compete 4,903 (1,982) 2,921 4,828 (1,604) 3,224

Favorable leases and other 762 (297) 465 756 (251) 505

$ 12,063 $ (2,279) $ 9,784 $ 11,982 $ (1,855) $ 10,127

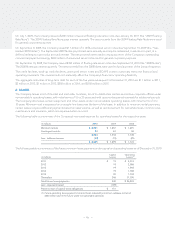

4: SHARE REPURCHASE PROGRAMS

On June 14, 2010, the Company’s Board of Directors authorized a new share repurchase program for up to $2.0 billion of

outstanding common stock (the “2010 Repurchase Program”). The share repurchase authorization, which was effective immedi-

ately and expires at the end of 2011, permits the Company to effect repurchases from time to time through a combination of

open market repurchases, privately negotiated transactions, accelerated share repurchase transactions, and/or other derivative

transactions. The share repurchase program may be modified, extended or terminated by the Board of Directors at any time.

The Company did not make any share repurchases under the 2010 Repurchase Program through December 31, 2010.

On November 4, 2009, the Company’s Board of Directors authorized, effective immediately, a share repurchase program for

up to $2.0 billion of its outstanding common stock (the “2009 Repurchase Program”). From November 4, 2009 through Decem-

ber 31, 2009, the Company repurchased 16.1 million shares of common stock for approximately $500 million under the 2009

Repurchase Program. During the year ended December 31, 2010, the Company repurchased 42.4 million shares of common

stock for approximately $1.5 billion completing the 2009 Repurchase Program.

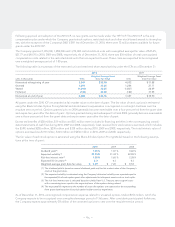

On May 7, 2008, the Company’s Board of Directors authorized, effective May 21, 2008, a share repurchase program for up to

$2.0 billion of its outstanding common stock (the “2008 Repurchase Program”). From May 21, 2008 through December 31, 2008,

the Company repurchased approximately 0.6 million shares of common stock for $23 million under the 2008 Repurchase Program.

During the year ended December 31, 2009, the Company repurchased approximately 57.0 million shares of common stock for

approximately $2.0 billion completing the 2008 Repurchase Program.

On May 9, 2007, the Company’s Board of Directors authorized a share repurchase program for up to $5.0 billion of its outstand-

ing common stock. The share repurchase program was completed during 2007 through a $2.5 billion fixed dollar accelerated

share repurchase agreement (the “May ASR agreement”), under which final settlement occurred in October 2007 and resulted

in the repurchase of approximately 67.5 million shares of common stock; an open market repurchase program, which concluded

in November 2007 and resulted in approximately 5.3 million shares of common stock being repurchased for approximately

$212 million; and a $2.3 billion dollar fixed accelerated share repurchase agreement (the “November ASR agreement”), which

resulted in an initial 51.6 million shares of common stock being purchased and placed into treasury stock as of December 29,

2007. The final settlement under the November ASR agreement occurred on March 28, 2008 and resulted in the Company receiv-

ing an additional 5.7 million shares of common stock, which were placed into treasury stock as of March 29, 2008.

– 59 –