CVS 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

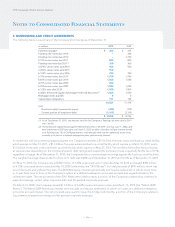

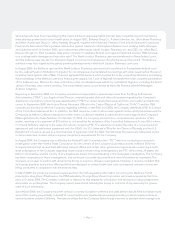

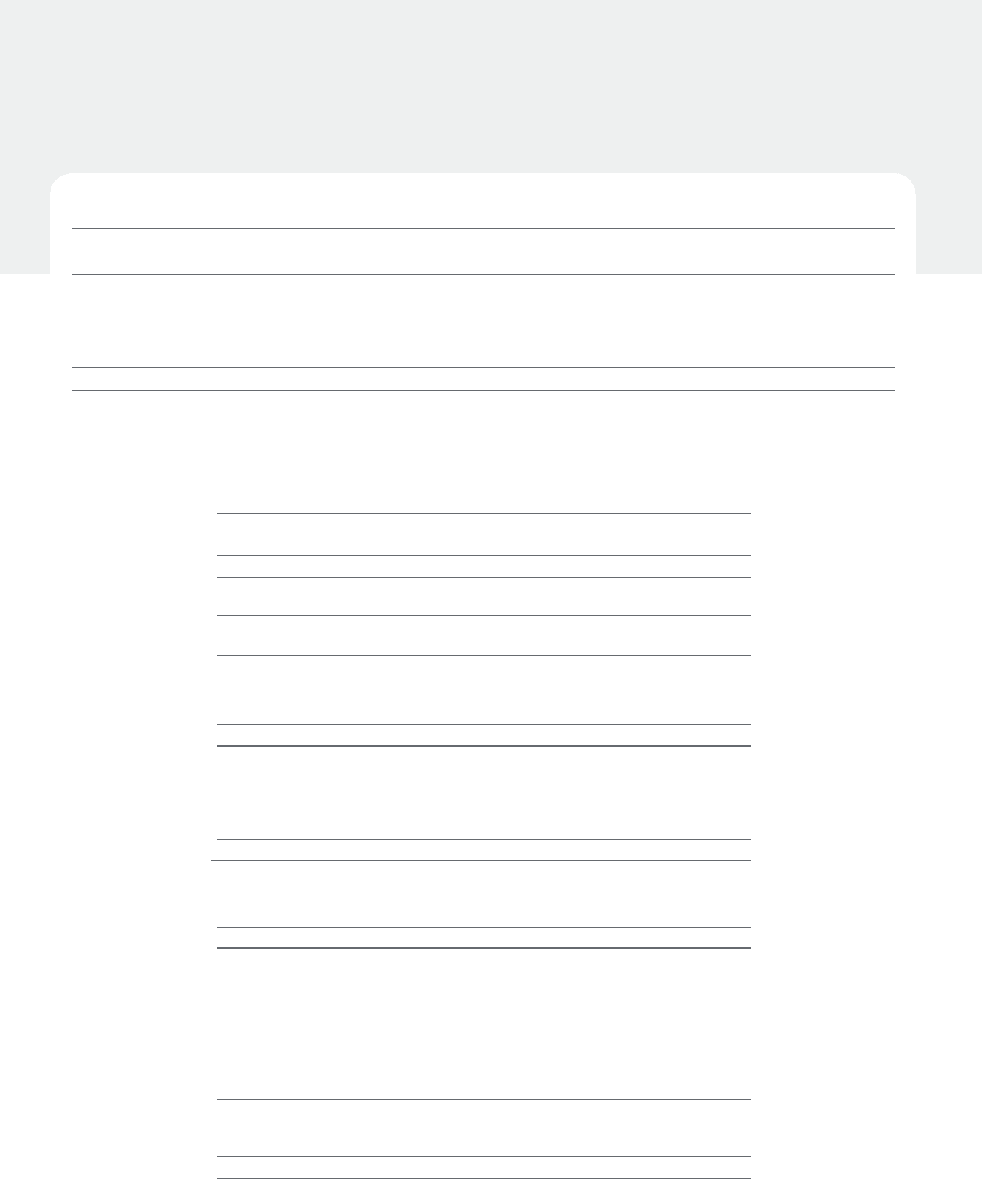

The following table is a summary of the Company’s stock option activity for the year ended December 31, 2010:

Weighted Average Aggregate

Weighted Average Remaining Intrinsic

shares in thousands Shares Exercise Price Contractual Term Value

Outstanding at December 31, 2009 66,269 $ 29.14 4.39 345,068,000

Granted 14,168 $ 35.16 – –

Exercised (10,463) $ 21.71 – –

Forfeited (2,332) $ 33.50 – –

Expired (1,625) $ 31.83 – –

Outstanding at December 31, 2010 66,017 $ 31.39 4.16 $ 313,163,000

Exercisable at December 31, 2010 36,789 $ 29.64 3.03 $ 235,843,000

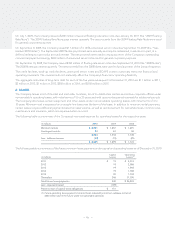

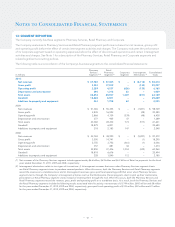

11: INCOME TAXES

The income tax provision consisted of the following for the respective years:

in millions 2010 2009 2008

Current: Federal $ 1,894 $ 1,766 $ 1,680

State 345 397 365

2,239 2,163 2,045

Deferred: Federal (44) 38 133

State (5) 4 15

(49) 42 148

Total $ 2,190 $ 2,205 $ 2,193

The following table is a reconciliation of the statutory income tax rate to the Company’s effective income tax rate for the

respective years:

2010 2009 2008

Statutory income tax rate 35.0 % 35.0 % 35.0 %

State income taxes, net of federal tax benefit 4.1 4.5 4.1

Other 0.6 0.6 0.5

Recognition of previously

unrecognized tax benefits (0.8) (2.8) –

Effective income tax rate 38.9 % 37.3 % 39.6 %

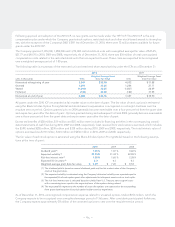

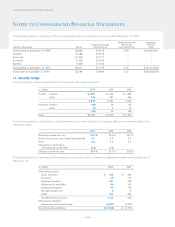

The following table is a summary of the significant components of the Company’s deferred tax assets and liabilities as of

December 31:

in millions 2010 2009

Deferred tax assets:

Lease and rents $ 325 $ 334

Inventory 69 55

Employee benefits 261 250

Allowance for bad debt 96 130

Retirement benefits 99 94

Net operating losses 6 8

Other 307 287

Total deferred tax assets 1,163 1,158

Deferred tax liabilities:

Depreciation and amortization (4,307) (4,330)

Net deferred tax liabilities $ (3,144) $ (3,172)

– 66 –

CVS Caremark 2010 Annual Report