CVS 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

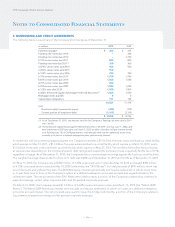

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

Effective January 1, 2009, the Company adopted Accounting Standards Codification (“ASC”) 805 Business Combinations

(“ASC 805”) (formerly Statement of Financial Accounting Standard (“SFAS”) No. 141 (R), “Business Combinations”). ASC 805

establishes the principles and requirements for how an acquirer recognizes and measures in its financial statements the identifi-

able assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and the goodwill acquired. The guidance

also establishes disclosure requirements that will enable users to evaluate the nature and financial effects of business combina-

tions. ASC 805 requires that income tax benefits related to business combinations that are not recorded at the date of acquisition

are recorded as an income tax benefit in the statement of income when subsequently recognized. Previously, unrecognized

income tax benefits related to business combinations were recorded as an adjustment to the purchase price allocation when

recognized. The Company recognized approximately $34 million and $147 million of previously unrecognized income tax

benefits related to business combinations (after considering the federal benefit of state taxes), plus interest, due to the expiration

of various statutes of limitation and settlements with tax authorities in 2010 and 2009, respectively. As of December 31, 2010 and

2009, the Company had approximately $10 million and $20 million, respectively, of unrecognized tax benefits (after considering

the federal benefit of state taxes), plus interest, related to business combinations that would have been treated as an adjustment

to the purchase price allocation if they would have been recognized under the previous business combination guidance.

In June 2009, the Financial Accounting Standards Board (“FASB”) issued guidance that amends ASC 810 Consolidations

(formerly SFAS No. 167, “Amendments to FASB Interpretation No. 46(R)”). The amendment requires a company to analyze

whether its interest in a variable interest entity (“VIE”) gives it a controlling financial interest. The determination of whether a

company is required to consolidate another entity is based on, among other things, the other entity’s purpose and design and

a company’s ability to direct the activities of the other entity that most significantly impact the other entity’s economic perfor-

mance. Additional disclosures are required to identify a company’s involvement with the VIE and any significant changes in risk

exposure due to such involvement. The amendment is effective for all new and existing VIEs as of the beginning of the first fiscal

year that begins after November 15, 2009. The adoption of this standard did not have a material impact on the Company’s

consolidated results of operations, financial position or cash flows.

In January 2010, the FASB issued guidance which expanded the required disclosures about fair value measurements. In particu-

lar, this guidance requires (i) separate disclosure of the amounts of significant transfers in and out of Level 1 and Level 2 fair value

measurements along with the reasons for such transfers, (ii) information about purchases, sales, issuances and settlements to be

presented separately in the reconciliation for Level 3 fair value measurements, (iii) expanded fair value measurement disclosures

for each class of assets and liabilities and (iv) disclosures about the valuation techniques and inputs used to measure fair value

for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3. This guidance is effective for

annual reporting periods beginning after December 15, 2009 except for (ii) above which is effective for fiscal years beginning

after December 15, 2010. The adoption of this standard did not have a material impact on the Company’s consolidated results

of operations, financial position or cash flows.

RECENTLY PROPOSED ACCOUNTING STANDARD UPDATE

In August 2010, the FASB issued a proposed accounting standard update on lease accounting that would require entities to

recognize assets and liabilities arising from lease contracts on the balance sheet. The proposed accounting standard update

states that lessees and lessors should apply a “right-of-use model” in accounting for all leases. Under the proposed model,

lessees would recognize an asset for the right to use the leased asset, and a liability for the obligation to make rental payments

over the lease term. The lease term is defined as the longest possible term that is “more likely than not” to occur. The accounting

by a lessor would reflect its retained exposure to the risks or benefits of the underlying leased asset. A lessor would recognize an

asset representing its right to receive lease payments based on the expected term of the lease. Comments on this exposure draft

were due December 15, 2010 and the final standard is expected to be issued sometime in 2011. While the Company believes that

the proposed standard, as currently drafted, will likely have a material impact on its reported financial position and reported

results of operations, it will not have a material impact on its liquidity; however, until the proposed standard is finalized, such

evaluation cannot be completed.

– 57 –