CVS 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

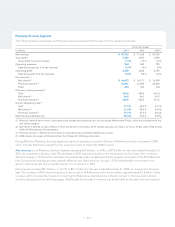

Industry-Leading Performance Across Several

Measures Characterizes the Year in Retail

Our retail stores continued to outperform competitors

and gain share in 2010, and we expect a similar out-

come in 2011. We led the industry with 2.1 percent

same-store sales growth; 2.9 percent in the pharmacy

and 0.5 percent in the front of the store. We also outper-

formed all drugstore chains in sales per square foot

and profitability measures.

We opened 285 new or relocated stores in 2010.

Factoring in closings, net units increased by 152 stores,

which equates to 2.9 percent retail square footage

growth. Over the next three years, we expect to add

approximately 150 net new stores annually. That would

increase our retail square footage growth each year by

2 to 3 percent. CVS/pharmacy

® entered nine new markets

over the past two years, and results have exceeded our

expectations. In 2010 alone, we opened our first stores in

Memphis, Omaha, St. Louis, and Puerto Rico.

As we accomplished with earlier acquisitions, we have

improved the performance of the Longs Drugs® stores

we purchased in 2008 across several key financial metrics.

By leveraging our systems, our focus on store brands,

our category mix, and our ExtraCare® loyalty card,

profitability in the Longs stores has improved signifi-

cantly. In addition, average store prescription volumes

have increased by more than 5 percent. Given the

much larger retail footprint and sales mix of the

acquired stores, we do not expect them to match the

sales productivity of our core CVS/pharmacy locations.

That said, we see significant upside and expect to close

the gap further over the next several years.

In the front of the store, our ambitious store brand

program generated more than $3 billion in sales in 2010.

Store brands now account for 17 percent of our front-end

total, and we believe that penetration can reach more

than 20 percent in the next two to three years. From

over-the-counter drugs to grocery items, we offer more

LETTER TO SHAREHOLDERS ( CONTI N UED)

A Message From Our Board of Directors

As Tom Ryan prepares to step down from his role as Chairman and Chief Executive Officer of CVS Caremark,

the Board of Directors wants to thank him for the enormous contributions he has made to the growth and

culture of our company over the past 35 years. Tom became President and CEO of CVS in 1994 when the

company had approximately 1,200 stores and was still a division of Melville Corporation. After overseeing

several very successful retail acquisitions over the years, Tom engineered the evolution of our model beyond

retail pharmacy to include MinuteClinic and the transformational merger with Caremark in 2007.

Today, CVS Caremark is the nation’s largest pharmacy care provider and the 18th-ranked company

on the Fortune 500. We operate more than 7,100 stores and a top-tier PBM that together generated more

than $96 billion in revenue in 2010. Since Tom took the helm, our market cap has grown from $4 billion to

roughly $45 billion, and we have averaged an 11.5 percent annual return to shareholders. Tom also developed

many key executives and assembled a talented team, including incoming CEO Larry Merlo. We are pleased

to have Larry assume the top spot and confident in his abilities to successfully lead the company forward. We

wish Tom all the best as he begins the next phase of his life.

– 16 –

CVS Caremark 2010 Annual Report