CVS 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

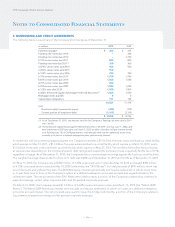

Notes to Consolidated Financial Statements

2: BUSINESS COMBINATIONS

Effective October 20, 2008, the Company acquired Longs Drug Stores Corporation for approximately $2.6 billion (the “Longs

Acquisition”). The fair value of the assets acquired and liabilities assumed were $4.4 billion and $1.8 billion, respectively. The

Longs Acquisition included 529 retail drug stores, RxAmerica, LLC, which provides pharmacy benefit management services and

Medicare Part D benefits and other related assets. The Company’s results of operations and cash flows include the Longs

Acquisition beginning October 20, 2008.

Effective December 30, 2009, the Company acquired an approximately 60% interest in Generation Health, a genetic benefit

management company for approximately $34 million in cash and issued certain put rights to the remaining noncontrolling

shareholders. The put rights allow the noncontrolling shareholders to require the Company to buy their shares for cash in the

future, depending on certain financial metrics of Generation Health. The fair value of the redeemable noncontrolling interest

including put rights on the date of acquisition was approximately $37 million which was determined using inputs classified as

Level 3 in the fair value hierarchy. The Company’s results of operations and cash flows include the Generation Health acquisition

beginning December 30, 2009.

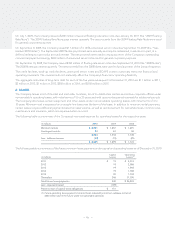

3: GOODWILL AND OTHER INTANGIBLES

Goodwill and other indefinitely-lived assets are not amortized, but are subject to annual impairment reviews, or more frequent

reviews if events or circumstances indicate impairment may exist.

When evaluating goodwill for potential impairment, the Company first compares the fair value of its two reporting units, the

PSS and RPS, to their respective carrying amounts. The Company estimates the fair value of its reporting units using a combina-

tion of a future discounted cash flow valuation model and a comparable market transaction model. As the Company utilizes

internal financial projections for the determination of future cash flows, the fair value methodology is considered to use inputs

classified as Level 3 in the fair value hierarchy. If the estimated fair value of the reporting unit is less than its carrying amount,

an impairment loss calculation is prepared. The impairment loss calculation compares the implied fair value of a reporting unit’s

goodwill with the carrying amount of its goodwill. If the carrying amount of the goodwill exceeds the implied fair value, an

impairment loss is recognized in an amount equal to the excess. During the third quarter of 2010, the Company performed its

required annual goodwill impairment tests. The Company concluded there were no goodwill impairments as of the testing date.

The carrying amount of goodwill was $25.7 billion as of December 31, 2010 and 2009.

Indefinitely-lived intangible assets are tested for impairment by comparing the estimated fair value of the asset to its carrying

value. The Company estimates the fair value of its indefinitely-lived trademark using the relief from royalty method under the

income approach. As this method of estimating fair value utilizes internal financial projections for determination of future cash

flows, the fair value methodology is considered to use inputs classified as Level 3 in the fair value hierarchy. If the carrying value

of the asset exceeds its estimated fair value, an impairment loss is recognized and the asset is written down to its estimated fair

value. During the third quarter of 2010, the Company performed its annual impairment test of the indefinitely-lived trademark

and concluded there was no impairment as of the testing date. The carrying amount of indefinitely-lived assets was $6.4 billion

as of December 31, 2010 and 2009. Intangible assets with finite useful lives are amortized over their estimated useful lives.

The Company amortizes intangible assets with finite lives over the estimated useful lives of the respective assets, which have

a weighted average useful life of 13.3 years. The weighted average useful lives of the Company’s customer contracts and

relationships and covenants not to compete are 12.9 years. The weighted average of the Company’s favorable leases and other

intangible assets are 16.3 years. Amortization expense for intangible assets totaled $427 million, $430 million and $405 million

in 2010, 2009 and 2008, respectively. The anticipated annual amortization expense for these intangible assets is $419 million in

2011, $399 million in 2012, $376 million in 2013, $344 million in 2014 and $316 million in 2015.

– 58 –

CVS Caremark 2010 Annual Report