CVS 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

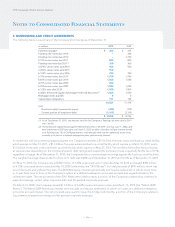

On July 1, 2009, the Company issued a $300 million unsecured floating rate senior note due January 30, 2011 (the “2009 Floating

Rate Note”). The 2009 Floating Rate Note pays interest quarterly. The net proceeds from the 2009 Floating Rate Note were used

for general corporate purposes.

On September 8, 2009, the Company issued $1.5 billion of 6.125% unsecured senior notes due September 15, 2039 (the “Sep-

tember 2009 Notes”). The September 2009 Notes pay interest semi-annually and may be redeemed, in whole or in part, at a

defined redemption price plus accrued interest. The net proceeds were used to repay a portion of the Company’s outstanding

commercial paper borrowings, $650 million of unsecured senior notes and for general corporate purposes.

On September 10, 2008, the Company issued $350 million of floating rate senior notes due September 10, 2010 (the “2008 Notes”).

The 2008 Notes pay interest quarterly. The net proceeds from the 2008 Notes were used to fund a portion of the Longs Acquisition.

The credit facilities, back-up credit facilities, unsecured senior notes and ECAPS contain customary restrictive financial and

operating covenants. The covenants do not materially affect the Company’s financial or operating flexibility.

The aggregate maturities of long-term debt for each of the five years subsequent to December 31, 2010 are $1.1 billion in 2011,

$2 million in 2012, $1 million in 2013, $550 million in 2014, and $550 million in 2015.

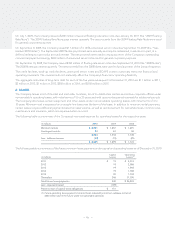

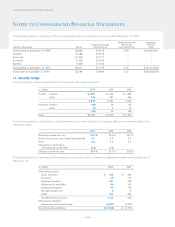

6: LEASES

The Company leases most of its retail and mail order locations, ten of its distribution centers and certain corporate offices under

noncancelable operating leases, with initial terms of 15 to 25 years and with options that permit renewals for additional periods.

The Company also leases certain equipment and other assets under noncancelable operating leases, with initial terms of 3 to

10 years. Minimum rent is expensed on a straight-line basis over the term of the lease. In addition to minimum rental payments,

certain leases require additional payments based on sales volume, as well as reimbursement for real estate taxes, common area

maintenance and insurance, which are expensed when incurred.

The following table is a summary of the Company’s net rental expense for operating leases for the respective years:

in millions 2010 2009 2008

Minimum rentals $ 2,001 $ 1,857 $ 1,691

Contingent rentals 53 61 58

2,054 1,918 1,749

Less: sublease income (19) (19) (25)

$ 2,035 $ 1,899 $ 1,724

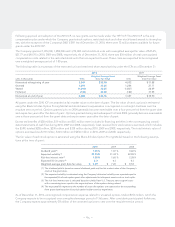

The following table is a summary of the future minimum lease payments under capital and operating leases as of December 31, 2010:

Capital Operating

in millions Leases Leases (1)

2011 $ 19 $ 2,013

2012 19 2,096

2013 19 1,992

2014 19 1,788

2015 20 1,724

Thereafter 244 17,190

Total future lease payments 340 $ 26,803

Less: imputed interest (189)

Present value of capital lease obligations $ 151

(1) Future operating lease payments have not been reduced by minimum sublease rentals of

$266 million due in the future under noncancelable subleases.

– 61 –