Bed, Bath and Beyond 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

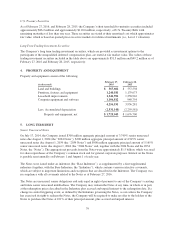

Revolving Credit Agreement

On August 6, 2014, the Company entered into a $250 million five year senior unsecured revolving credit facility

agreement (“Revolver”) with various lenders. For fiscal 2015 and during the period from August 6, 2014 through

February 28, 2015, the Company did not have any borrowings under the Revolver.

Borrowings under the Revolver accrue interest at either (1) a fluctuating rate equal to the greater of the prime

rate, as defined in the Revolver, the Federal Funds Rate plus 0.50%, or one-month LIBOR plus 1.0% and, in each

case, plus an applicable margin based upon the Company’s leverage ratio which is calculated quarterly, (2) a

periodic fixed rate equal to LIBOR plus an applicable margin based upon the Company’s leverage ratio which is

calculated quarterly or (3) an agreed upon fixed rate. In addition, a commitment fee is assessed, which is

included in interest expense, net in the Consolidated Statement of Earnings. The Revolver contains customary

affirmative and negative covenants and also requires the Company to maintain a minimum leverage ratio. The

Company was in compliance with all covenants related to the Revolver as of February 27, 2016.

Deferred financing costs associated with the Notes and the Revolver of approximately $10.1 million were

capitalized and are included in other assets, net of amortization, in the accompanying Consolidated Balance

Sheets. These deferred financing costs are being amortized over the term of each of the Notes and the term of the

Revolver and such amortization is included in interest expense, net in the Consolidated Statement of Earnings.

Interest expense related to the Notes and the Revolver, including the commitment fee and the amortization of the

deferred financing costs, was approximately $73.0 million for fiscal 2015 and $44.9 million for the period from

July 17, 2014 through February 28, 2015.

Lines of Credit

At February 27, 2016, the Company maintained two uncommitted lines of credit of $100 million each, with

expiration dates of August 31, 2016 and February 26, 2017, respectively. These uncommitted lines of credit are

currently and are expected to be used for letters of credit in the ordinary course of business. During fiscal 2015

and 2014, the Company did not have any direct borrowings under the uncommitted lines of credit. As of

February 27, 2016, there was approximately $9.5 million of outstanding letters of credit. Although no assurances

can be provided, the Company intends to renew both uncommitted lines of credit before the respective expiration

dates. In addition, as of February 27, 2016, the Company maintained unsecured standby letters of credit of $51.2

million, primarily for certain insurance programs. As of February 28, 2015, there was approximately $11.1

million of outstanding letters of credit and approximately $71.7 million of outstanding unsecured standby letters

of credit, primarily for certain insurance programs.

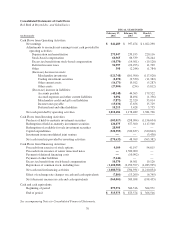

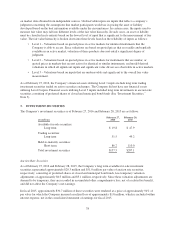

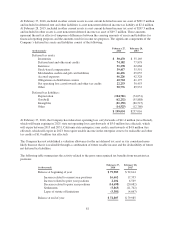

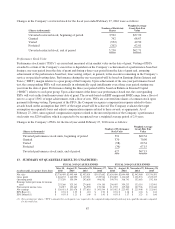

6. PROVISION FOR INCOME TAXES

The components of the provision for income taxes are as follows:

FISCAL YEAR ENDED

(in thousands)

February 27,

2016

February 28,

2015

March 1,

2014

Current:

Federal $389,039 $504,154 $514,818

State and local 39,991 64,486 64,581

429,030 568,640 579,399

Deferred:

Federal 42,592 (18,245) 11,221

State and local 14,334 (4,034) 537

56,926 (22,279) 11,758

$485,956 $546,361 $591,157

80