Bed, Bath and Beyond 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL 3—APPROVAL, BY NON-BINDING VOTE, OF 2015 EXECUTIVE COMPENSATION

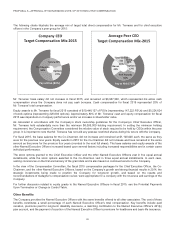

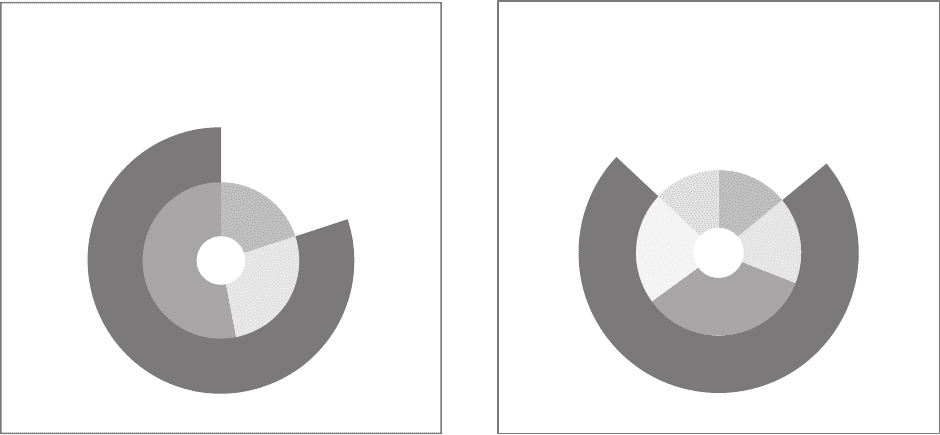

The following charts illustrate the average mix of target total direct compensation for Mr. Temares and for chief executive

officers in the Company’s peer group for 2015:

Company CEO

Target Compensation Mix-2015

Salary 20%

Perf Awards

53% Options

27%

Pay at Risk (80%)

Salary

14%

Options

17%

Perf Awards

34%

Bonus

22%

Time Vested

Stk

13%

Pay at Risk (73%)

Average Peer CEO

Target Compensation Mix-2015

Mr. Temares’ base salary did not increase in fiscal 2015, and remained at $3,967,500, which represented his entire cash

compensation since the Company does not pay cash bonuses. Cash compensation for fiscal 2015 represented 20% of

Mr. Temares’ total compensation.

Equity awards to Mr. Temares for fiscal 2015 consisted of $10,446,137 of PSUs (representing 147,222 PSUs) and $5,224,624

of stock options (representing 226,003 options). Approximately 80% of Mr. Temares’ cash and equity compensation for fiscal

2015 was dependent on Company performance and/or an increase in shareholder value.

As calculated in accordance with the Company’s stock ownership guidelines for the Company’s Chief Executive Officer,

Mr. Temares held substantially more than the minimum $6,000,000 holding requirement. In setting the minimum holding

requirement, the Compensation Committee considered the relative value of stock required to be held by CEOs within the peer

group. It is important to note that Mr. Temares has not sold any post-tax restricted shares during his tenure with the Company.

For fiscal 2015, the base salaries for the Co-Chairmen did not increase and remained at $1,100,000 each, the same as they

were for the previous nine years. Equity awards in 2015 for the Co-Chairmen did not increase and have remained in the same

amount as they were for the previous four years (rounded to the next full share). The base salaries and equity awards of the

other Named Executive Officers increased based upon several factors including increased responsibilities and in certain cases

individual performance.

The stock options granted to the Chief Executive Officer and the other Named Executive Officers vest in five equal annual

installments, while the stock options awarded to the Co-Chairmen vest in three equal annual installments. In each case,

vesting commences on the first anniversary of the grant date and is also based on continued service to the Company.

In the view of the Compensation Committee, the fiscal 2015 compensation packages for the Chief Executive Officer, the Co-

Chairmen, and the other Named Executive Officers, based on the Company’s growth and strong financial results in 2014, the

strategic investments being made to position the Company for long-term growth, and based on the results and

recommendations of Gallagher’s compensation review, were appropriate for a company with the revenues and earnings of the

Company.

For further discussion related to equity grants to the Named Executive Officers in fiscal 2015, see the Potential Payments

Upon Termination or Change in Control Table.

Other Benefits

The Company provides the Named Executive Officers with the same benefits offered to all other associates. The cost of these

benefits constitutes a small percentage of each Named Executive Officer’s total compensation. Key benefits include paid

vacation, premiums paid for long-term disability insurance, a matching contribution to the Named Executive Officer’s 401(k)

plan account, and the payment of a portion of the Named Executive Officer’s premiums for healthcare and basic life insurance.

28