Bed, Bath and Beyond 2015 Annual Report Download - page 89

Download and view the complete annual report

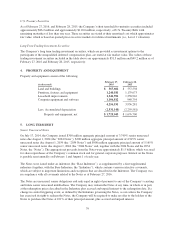

Please find page 89 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock-based awards of approximately 2.6 million, 1.7 million and 1.2 million shares were excluded from the

computation of diluted earnings per share as the effect would be anti-dilutive for fiscal 2015, 2014 and 2013,

respectively.

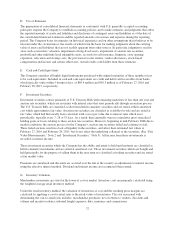

W. Recent Accounting Pronouncements

In May 2014, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

2014-09, Revenue from Contracts with Customers. This guidance requires an entity to recognize revenue in a

manner that depicts the transfer of promised goods or services to customers in an amount that reflects the

consideration to which the entity expects to be entitled in exchange for those goods or services. The new standard

also will result in enhanced disclosures about the nature, amount, timing and uncertainty of revenue and cash

flows arising from contracts with customers. In July 2015, the FASB issued ASU 2015-14, Revenue from

Contracts with Customers (Topic 606): Deferral of the Effective Date. This guidance deferred the effective date

of ASU 2014-09 for one year from the original effective date. In accordance with the deferral, ASU 2014-09 is

effective for annual reporting periods beginning after December 15, 2017, including interim periods within that

reporting period. ASU 2014-09 can be adopted either retrospectively to each prior reporting period presented or

as a cumulative-effect adjustment as of the date of adoption. The adoption of this guidance is not expected to

have a significant effect on the Company’s consolidated financial position, results of operations, or cash flows.

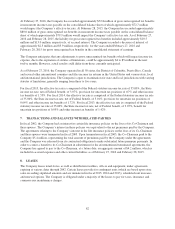

In April 2015, the FASB issued ASU 2015-03, Interest-Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs. This guidance requires an entity to present debt issuance costs related to a

recognized debt liability on the balance sheet as a direct deduction from the carrying amount of that debt liability,

consistent with debt discounts. Costs associated with line-of-credit arrangements may continue to be recorded as

deferred assets. ASU 2015-03 is effective for annual reporting periods beginning after December 15, 2015,

including interim periods within that reporting period, with earlier adoption permitted. ASU 2015-03 must be

adopted retrospectively to each prior reporting period presented. The adoption of this guidance is not expected to

have a significant effect on the Company’s consolidated financial position, results of operations, or cash flows.

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740): Balance Sheet Classification of

Deferred Taxes. This guidance requires an entity to classify deferred tax assets and liabilities as noncurrent on

the balance sheet. ASU 2015-17 is effective for annual reporting periods beginning after December 15, 2016,

including interim periods within that reporting period, with earlier adoption permitted. ASU 2015-17 can be

adopted either retrospectively to each prior reporting period presented or as a cumulative-effect adjustment as of

the date of adoption. The adoption of this guidance is not expected to have a significant effect on the Company’s

consolidated financial position, results of operations, or cash flows.

In February 2016, the FASB issued ASU 2016-02, Leases. This guidance requires an entity to recognize lease

liabilities and a right-of-use asset for all leases on the balance sheet and to disclose key information about the

entity’s leasing arrangements. ASU 2016-02 is effective for annual reporting periods beginning after

December 15, 2018, including interim periods within that reporting period, with earlier adoption permitted. ASU

2016-02 must be adopted using a modified retrospective approach for all leases existing at, or entered into after

the date of initial adoption, with an option to elect to use certain transition relief. The Company is evaluating the

impact of this new standard on its financial position, results of operations, cash flows and related disclosures.

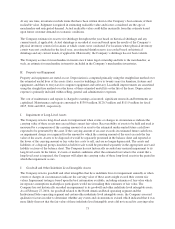

2. FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., “the

exit price”) in an orderly transaction between market participants at the measurement date. In determining fair

value, the Company uses various valuation approaches, including quoted market prices and discounted cash

flows. The hierarchy for inputs used in measuring fair value maximizes the use of observable inputs and

minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available.

Observable inputs are inputs that market participants would use in pricing the asset or liability developed based

77