Bed, Bath and Beyond 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. Treasury Securities

As of February 27, 2016, and February 28, 2015, the Company’s short term held-to-maturity securities included

approximately $86.2 million and approximately $110.0 million, respectively, of U.S. Treasury Bills with

remaining maturities of less than one year. These securities are stated at their amortized cost which approximates

fair value, which is based on quoted prices in active markets for identical instruments (i.e., Level 1 valuation).

Long Term Trading Investment Securities

The Company’s long term trading investment securities, which are provided as investment options to the

participants of the nonqualified deferred compensation plan, are stated at fair market value. The values of these

trading investment securities included in the table above are approximately $51.5 million and $49.2 million as of

February 27, 2016 and February 28, 2015, respectively.

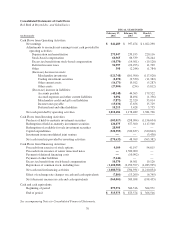

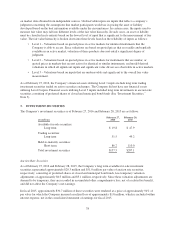

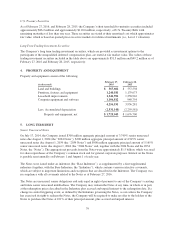

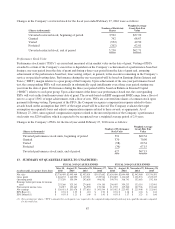

4. PROPERTY AND EQUIPMENT

Property and equipment consist of the following:

(in thousands)

February 27,

2016

February 28,

2015

Land and buildings $ 567,602 $ 557,538

Furniture, fixtures and equipment 1,240,181 1,179,073

Leasehold improvements 1,341,596 1,258,916

Computer equipment and software 1,106,812 940,754

4,256,191 3,936,281

Less: Accumulated depreciation (2,531,148) (2,259,581)

Property and equipment, net $ 1,725,043 $ 1,676,700

5. LONG TERM DEBT

Senior Unsecured Notes

On July 17, 2014, the Company issued $300 million aggregate principal amount of 3.749% senior unsecured

notes due August 1, 2024 (the “2024 Notes”), $300 million aggregate principal amount of 4.915% senior

unsecured notes due August 1, 2034 (the “2034 Notes”) and $900 million aggregate principal amount of 5.165%

senior unsecured notes due August 1, 2044 (the “2044 Notes” and, together with the 2024 Notes and the 2034

Notes, the “Notes”). The aggregate net proceeds from the Notes were approximately $1.5 billion, which was used

for share repurchases of the Company’s common stock and for general corporate purposes. Interest on the Notes

is payable semi-annually on February 1 and August 1 of each year.

The Notes were issued under an indenture (the “Base Indenture”), as supplemented by a first supplemental

indenture (together, with the Base Indenture, the “Indenture”), which contains various restrictive covenants,

which are subject to important limitations and exceptions that are described in the Indenture. The Company was

in compliance with all covenants related to the Notes as of February 27, 2016.

The Notes are unsecured, senior obligations and rank equal in right of payment to any of the Company’s existing

and future senior unsecured indebtedness. The Company may redeem the Notes at any time, in whole or in part,

at the redemption prices described in the Indenture plus accrued and unpaid interest to the redemption date. If a

change in control triggering event, as defined by the Indenture governing the Notes, occurs unless the Company

has exercised its right to redeem the Notes, the Company will be required to make an offer to the holders of the

Notes to purchase the Notes at 101% of their principal amount, plus accrued and unpaid interest.

79