Bed, Bath and Beyond 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

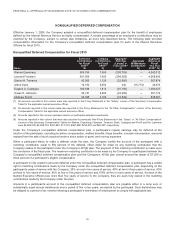

PROPOSAL 5—SHAREHOLDER PROPOSAL REGARDING AN EQUITY RETENTION POLICY FOR SENIOR EXECUTIVES

Our Named Executive Officers currently hold a substantial amount of, and have a substantial economic

interest in, our common stock.

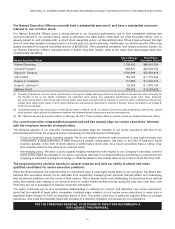

Our Named Executive Officers have a strong interest in our long-term performance due to their substantial holdings and

economic interest in our common stock, which is reflected in the table below. Other than our Chief Executive Officer, who is

already subject to, and complies with, a robust stock ownership policy, our Named Executive Officers have achieved this high

level of ownership despite not being bound to a formal policy for stock ownership. Additionally, our Chief Executive Officer has

greatly exceeded his required ownership amount of $6,000,000. This substantial ownership, and related economic interest, by

our Named Executive Officers motivates them to deliver long-term results, while at the same time discourages them from

unreasonable risk-taking.

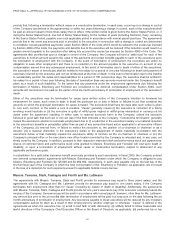

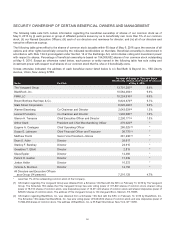

Named Executive Officer

Shares/Shares

Equivalent(1)

Share/Share

Equivalent Value(2)

Warren Eisenberg 1,108,420 $48,841,554

Leonard Feinstein 968,521 $42,509,725

Steven H. Temares 1,550,598 $37,558,815

Arthur Stark 189,165 $ 7,110,643

Eugene A. Castagna 177,869 $ 6,346,314

Susan E. Lattmann(3) 32,593 $ 1,475,159

Matthew Fiorilli 193,474 $ 6,293,409

(1) Includes (i) shares of common stock held directly or through an estate planning vehicle for the benefit of the executive (but not solely for

the benefit of his or her family members); (ii) restricted stock where any applicable performance goals have been achieved;

(iii) performance stock units whose performance goals have been achieved and (iv) shares of common stock underlying in-the-money,

vested stock options (the value of such option shares are calculated as described in footnote 2 below). Share ownership is as of May 6,

2016, the record date.

(2) Calculated based on the closing price of $45.26 per share on May 6, 2016. For shares of common stock underlying in-the-money, vested

stock options, value reflects the difference between the aforementioned closing price and the exercise price.

(3) Ms. Lattmann became an executive officer on February 26, 2014. These numbers reflect her shorter tenure as a Named Executive Officer.

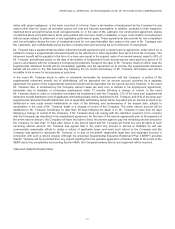

Our current executive compensation program and policies already align our senior executives’ interests

with the long-term interests of shareholders.

The following aspects of our executive compensation program align the interests of our senior executives with that of our

shareholders and render the proposed policy unnecessary for the achievement of that goal.

• Focus on long-term equity incentive awards. We do not employ short-term cash incentives or pay cash bonuses, and

consequently, a large proportion of each executive’s annual compensation has been in the form of long-term equity

incentive awards, in the form of stock options or performance stock units. As a result, executives have a rolling, long-

term incentive linked to the value of our common stock.

• Anti-hedging policy. We have a policy against hedging transactions with respect to our Company’s securities, and this

policy further aligns the interests of our senior executives with that of our shareholders by prohibiting our executives from

engaging in transactions designed to hedge or offset decreases in the market value of our common stock that they hold.

The proposed policy could be harmful in several respects and limit our ability to attract and retain

qualified candidates for senior executive positions.

While the Board believes it is important that our executives have a meaningful equity stake in our Company, the Board also

believes that executives should not be restricted from responsibly managing their personal financial affairs and diversifying

their investment portfolios over the course of their careers. This is already made more challenging for executives by an internal

policy that restricts their trading in our common stock to certain limited window periods during the year and, even then, only

when they are not in possession of material, nonpublic information.

The policy could also put us at a competitive disadvantage in retaining our current, and attracting new, senior executives,

given that the majority of large public companies, including major retailers, do not require senior executives to retain such a

significant share interest for such an extended period of time. This policy could have a particular negative effect on younger

executives, who could be potentially faced with decades of a retention obligation not imposed by our competitors.

FOR THE FOREGOING REASONS, YOUR BOARD OF DIRECTORS RECOMMENDS A

VOTE AGAINST THIS PROPOSAL.

47