Bed, Bath and Beyond 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

repurchases as of February 27, 2016. The Company’s share repurchase program could change, and would be

influenced by several factors, including business and market conditions.

Subsequent to the end of fiscal 2015, on April 6, 2016, the Company’s Board of Directors authorized a quarterly

dividend program, and declared an initial quarterly dividend of $.125 per share to be paid on July 19, 2016 to

shareholders of record as of June 17, 2016. The Company expects to pay quarterly cash dividends on its common

stock, in the future, subject to the determination by the Board of Directors based on an evaluation of the

Company’s earnings, financial condition and requirements, business conditions and other factors.

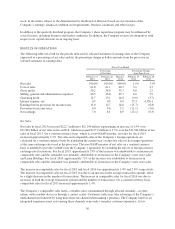

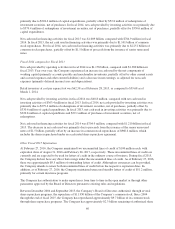

The Company has contractual obligations consisting mainly of principal and interest related to the Notes,

operating leases for stores, offices, distribution facilities and equipment, purchase obligations, long-term sale/

leaseback and capital lease obligations and other long-term liabilities which the Company is obligated to pay as

of February 27, 2016 as follows:

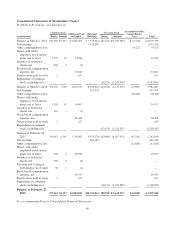

(in thousands) Total

Less than 1

year 1-3 years 4-5 years

After 5

years

Senior unsecured notes (1) $1,500,000 $ — $ — $ — $1,500,000

Interest on senior unsecured notes (1) 1,693,205 72,477 144,954 144,954 1,330,820

Operating lease obligations (2) 3,284,725 585,118 1,011,305 732,659 955,643

Purchase obligations (3) 1,137,597 1,137,597 — — —

Long-term sale/leaseback and capital lease

obligations (4) 326,674 10,366 20,896 21,176 274,236

Other long-term liabilities (5) 462,901 — — — —

Total Contractual Obligations $8,405,102 $1,805,558 $1,177,155 $898,789 $4,060,699

(1) On July 17, 2014, the Company issued $300 million aggregate principal amount of 3.749% senior unsecured

notes due August 1, 2024, $300 million aggregate principal amount of 4.915% senior unsecured notes due

August 1, 2034 and $900 million aggregate principal amount of 5.165% senior unsecured notes due

August 1, 2044.

(2) The amounts presented represent the future minimum lease payments under non-cancelable operating

leases. In addition to minimum rent, certain of the Company’s leases require the payment of additional costs

for insurance, maintenance and other costs. These additional amounts are not included in the table of

contractual commitments as the timing and/or amounts of such payments are not known. As of February 27,

2016, the Company has leased sites for 41 new or relocated locations planned for opening in fiscal 2016,

2017 or 2018, for which aggregate minimum rental payments over the term of the leases are approximately

$312.2 million and are included in the table above.

(3) Purchase obligations primarily consist of purchase orders for merchandise.

(4) Long-term sale/leaseback and capital lease obligations represent future minimum lease payments under the

sale/leaseback agreements and capital lease agreements.

(5) Other long-term liabilities are primarily comprised of income taxes payable, deferred rent, workers’

compensation and general liability reserves and various other accruals and are recorded as Deferred Rent

and Other Liabilities and Income Taxes Payable in the Consolidated Balance Sheet as of February 27, 2016.

The amounts associated with these other long-term liabilities have been reflected only in the Total Column

in the table above as the timing and / or amount of any cash payment is uncertain.

SEASONALITY

The Company’s sales exhibit seasonality with sales levels generally higher in the calendar months of August,

November and December, and generally lower in February.

61