Bed, Bath and Beyond 2015 Annual Report Download - page 53

Download and view the complete annual report

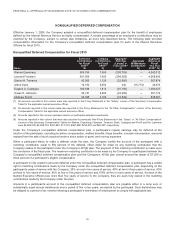

Please find page 53 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PROPOSAL 3—APPROVAL, BY NON-BINDING VOTE, OF 2015 EXECUTIVE COMPENSATION

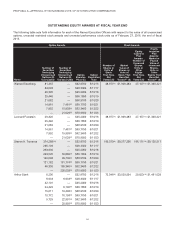

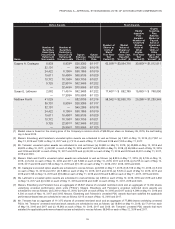

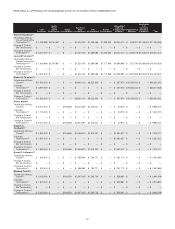

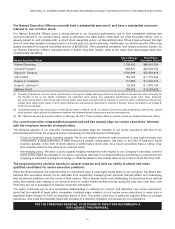

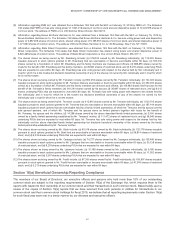

(1) Cash severance represents current salary continuation through February 25, 2017.

(2) In the event of a termination of employment due to death or disability, each of Messrs. Eisenberg and Feinstein (or their respective estates) will receive the

same payments as if there was a “Termination Without Cause/Constructive Termination,” except that neither Mr. Eisenberg nor Mr. Feinstein (nor their

respective estates) will receive either “Senior Status Salary Continuation” or “Benefit Continuation” payments.

(3) Represents $400,000, adjusted for the cost of living increase between June 30, 2000 and June 30, 2015 for the CPI-U for NY, Northern NJ and LI, for 10

years during the Senior Status Period.

(4) Represents the value of unvested outstanding stock options and restricted stock that would accelerate and vest on a termination occurring on February 27,

2016. In the case of stock options, the value is calculated by multiplying the number of shares underlying each accelerated unvested stock option by the

difference between the Per Share Closing Price and the per share exercise price. In the case of restricted stock, the value is calculated by multiplying the

number of shares of restricted stock that accelerate and vest by the Per Share Closing Price.

(5) Represents the value of unvested outstanding performance stock unit (PSU) awards that would accelerate and vest on a termination without cause (and, in

the cases of Messrs. Eisenberg and Feinstein, upon a termination without cause or constructive termination), subject to attainment of any applicable

performance goals and after the Compensation Committee certifies achievement of the applicable performance test. These values represent acceleration of

the portion of (i) the 2014 PSU awards for which the one-year performance test has been met and (ii) the 2015 PSU awards subject to the one-year

performance test at target, which result was reasonably estimable on February 27, 2016 based on assumptions regarding the performance of the peer

companies. The portion of 2014 and 2015 PSU awards subject to a three-year performance test, based on relative performance against the peer companies,

was substantially uncertain on February 27, 2016 and is not included. For a more complete discussion of the metrics and method of calculating the applicable

performance metrics for PSU awards, please see the discussion of Performance Stock Units in the Equity Compensation section of the Compensation

Discussion & Analysis above.

(6) Represents the estimated present value of continued health and welfare benefits and other perquisites for the life of the executive and his spouse.

(7) Reflects executives’ vested account balances as of February 27, 2016.

(8) For Messrs. Eisenberg and Feinstein, represents the estimated present value of lifetime supplemental pension payments, commencing six months following

the conclusion of the Senior Status Period. For Mr. Temares, present value will be paid out six months following (1) termination without cause or (2) any

termination (including voluntary termination) following a change in control.

(9) This amount will be paid on the last day of the following fiscal year.

(10) The employment agreements of Messrs. Eisenberg and Feinstein provide that in the event any amounts paid or provided to the executive in connection with a

change in control are determined to constitute “excess parachute payments” under Section 280G of the Code which would be subject to the excise tax

imposed by Section 4999 of the Code, the payments and benefits due to the executive will be reduced if the reduction would result in a greater amount

payable to the executive after taking into account the excise tax imposed by Section 4999 of the Code. However, no reduction of payments and benefits are

disclosed above since neither of these executives would have been subject to excise taxes as a result of payments subject to Section 280G of the Code that

would have been made in connection with a change in control occurring on February 27, 2016.

(11) Cash severance represents three times current salary payable over a period of three years following a termination without cause; or, in the cases of Messrs.

Eisenberg and Feinstein, following a termination without cause or constructive termination occurring on a change in control or within two years following a

change in control.

(12) In the event of a termination of employment due to death or disability, Mr. Temares (or his estate) will receive the same payments as if there was a

“Termination Without Cause.”

(13) Cash severance represents one times current salary payable over a period of one year.

(14) In the event of a termination of employment due to death or disability, the Named Executive Officer (or the executive’s estate) will receive the same payments

as if there were a “Termination Without Cause.”

43