Bed, Bath and Beyond 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and concluded no such events or circumstances existed which would require an impairment test being performed.

In the future, if events or market conditions affect the estimated fair value to the extent that an asset is impaired,

the Company will adjust the carrying value of these assets in the period in which the impairment occurs.

Included within other assets in the accompanying consolidated balance sheets as of February 27, 2016 and

February 28, 2015, respectively, are $291.4 million for indefinite lived tradenames and trademarks.

K. Self Insurance

The Company utilizes a combination of insurance and self insurance for a number of risks including workers’

compensation, general liability, automobile liability and employee related health care benefits (a portion of which

is paid by its employees). Liabilities associated with the risks that the Company retains are estimated by

considering historical claims experience, demographic factors, severity factors and other actuarial assumptions.

Although the Company’s claims experience has not displayed substantial volatility in the past, actual experience

could materially vary from its historical experience in the future. Factors that affect these estimates include but

are not limited to: inflation, the number and severity of claims and regulatory changes. In the future, if the

Company concludes an adjustment to self insurance accruals is required, the liability will be adjusted

accordingly.

L. Deferred Rent

The Company accounts for scheduled rent increases contained in its leases on a straight-line basis over the term

of the lease beginning as of the date the Company obtained possession of the leased premises. Deferred rent

amounted to $77.3 million and $77.8 million as of February 27, 2016 and February 28, 2015, respectively.

Cash or lease incentives (“tenant allowances”) received pursuant to certain store leases are recognized on a

straight-line basis as a reduction to rent over the lease term. The unamortized portion of tenant allowances is

included in deferred rent and other liabilities. The unamortized portion of tenant allowances amounted to $119.8

million and $121.0 million as of February 27, 2016 and February 28, 2015, respectively.

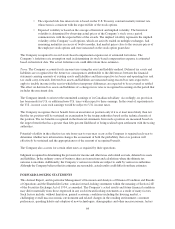

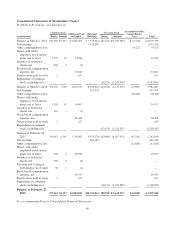

M. Shareholders’ Equity

The Company has authorization to make repurchases from time to time in the open market or through other

parameters approved by the Board of Directors pursuant to existing rules and regulations.

Between December 2004 and September 2015, the Company’s Board of Directors authorized, through several

share repurchase programs, the repurchase of $11.950 billion of the Company’s shares of common stock. On

July 17, 2014, the Company entered into an accelerated share repurchase agreement (“ASR”) with an investment

bank to repurchase an aggregate $1.1 billion of the Company’s common stock. The ASR was completed in

December 2014. The total number of shares repurchased under the ASR was 16.8 million shares at a weighted

average share price of $65.41. Since 2004 through the end of fiscal 2015, the Company has repurchased

approximately $9.7 billion of its common stock through share repurchase programs, which include the shares

repurchased under the ASR.

During fiscal 2015, the Company repurchased approximately 18.4 million shares of its common stock at a total

cost of approximately $1.101 billion. During fiscal 2014, including the shares repurchased under the ASR, the

Company repurchased approximately 33.0 million shares of its common stock at a total cost of approximately

$2.251 billion. During fiscal 2013, the Company repurchased approximately 18.3 million shares of its common

stock at a total cost of approximately $1.284 billion. The Company has approximately $2.3 billion remaining of

authorized share repurchases as of February 27, 2016.

74