Bed, Bath and Beyond 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

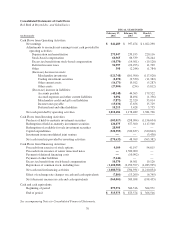

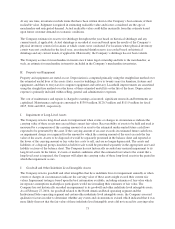

Consolidated Statements of Earnings

Bed Bath & Beyond Inc. and Subsidiaries

FISCAL YEAR ENDED

(in thousands, except per share data)

February 27,

2016

February 28,

2015

March 1,

2014

Net sales $12,103,887 $11,881,176 $11,503,963

Cost of sales 7,483,577 7,261,397 6,938,381

Gross profit 4,620,310 4,619,779 4,565,582

Selling, general and administrative expenses 3,205,407 3,065,486 2,950,995

Operating profit 1,414,903 1,554,293 1,614,587

Interest expense, net 87,458 50,458 1,140

Earnings before provision for income taxes 1,327,445 1,503,835 1,613,447

Provision for income taxes 485,956 546,361 591,157

Net earnings $ 841,489 $ 957,474 $ 1,022,290

Net earnings per share – Basic $ 5.15 $ 5.13 $ 4.85

Net earnings per share – Diluted $ 5.10 $ 5.07 $ 4.79

Weighted average shares outstanding – Basic 163,257 186,659 210,710

Weighted average shares outstanding – Diluted 165,016 188,880 213,363

See accompanying Notes to Consolidated Financial Statements.

67