Bed, Bath and Beyond 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROPOSAL 3—APPROVAL, BY NON-BINDING VOTE, OF 2015 EXECUTIVE COMPENSATION

Compensation Tables

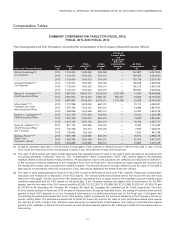

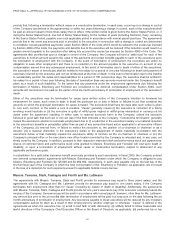

SUMMARY COMPENSATION TABLE FOR FISCAL 2015,

FISCAL 2014 AND FISCAL 2013

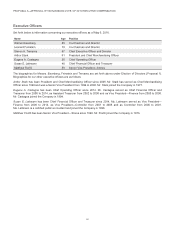

The following table sets forth information concerning the compensation of the Company’s Named Executive Officers.

Name and Principal Position

Fiscal

Year

Salary(1)

($)

Stock

Awards(2)(3)

($)

Option

Awards(2)

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Warren Eisenberg(4)(5)

Co-Chairman

2015 1,100,000 1,500,060 500,008 — 147,887 3,247,955

2014 1,100,000 1,500,025 500,010 — 145,635 3,245,670

2013 1,100,000 1,500,023 500,019 — 153,138 3,253,180

Leonard Feinstein(6)(7)

Co-Chairman

2015 1,100,000 1,500,060 500,008 — 165,878 3,265,946

2014 1,100,000 1,500,025 500,010 — 160,213 3,260,248

2013 1,100,000 1,500,023 500,019 — 163,564 3,263,606

Steven H. Temares(8)(9)(10)

Chief Executive Officer

2015 3,967,500 10,446,137 5,224,624 (242,787) 14,194 19,409,668

2014 3,967,500 9,712,323 4,856,147 556,242 23,828 19,116,040

2013 3,867,981 6,750,034 6,750,011 1,753,736 22,993 19,144,755

Arthur Stark(11)(12)

President and Chief

Merchandising Officer

2015 1,770,769 1,675,035 600,015 — 15,112 4,060,931

2014 1,670,769 1,550,022 600,012 — 14,699 3,835,502

2013 1,568,846 1,450,064 600,014 — 14,352 3,633,276

Eugene A. Castagna(13)(14)

Chief Operating Officer

2015 1,811,154 1,750,034 750,001 — 12,000 4,323,189

2014 1,670,769 1,550,022 600,012 — 13,878 3,834,681

2013 1,421,154 1,450,126 600,014 — 16,416 3,487,710

Susan E. Lattmann(15)(16)

Chief Financial Officer

and Treasurer

2015 871,154 900,064 400,002 — 8,262 2,179,482

2014 730,769 750,013 300,006 — 7,955 1,788,743

2013 534,908 300,058 — — 7,820 842,786

Matthew Fiorilli(17)(18)

Senior Vice

President—Stores

2015 1,655,769 1,425,060 600,015 — 18,572 3,699,416

2014 1,555,769 1,300,038 600,012 — 22,154 3,477,973

2013 1,453,846 1,200,060 600,014 — 21,825 3,275,745

(1) Except as otherwise described in this Summary Compensation Table, salaries to Named Executive Officers were paid in cash in fiscal

2015, fiscal 2014 and fiscal 2013, and increases in salary, if any, were effective in May of the fiscal year.

(2) The value of stock awards and option awards represents their respective total fair value on the date of grant calculated in accordance with

Accounting Standards Codification Topic No. 718, “Compensation—Stock Compensation” (“ASC 718”), without regard to the estimated

forfeiture related to service-based vesting conditions. All assumptions made in the valuations are contained and described in footnote 12

to the Company’s financial statements in the Company’s Form 10-K for fiscal 2015. Stock awards and option awards are rounded up to

the nearest whole share when converted from dollars to shares. The amounts shown in the table reflect the total fair value on the date of

grant and do not necessarily reflect the actual value, if any, that may be realized by the Named Executive Officers.

(3) The value of stock awards granted in fiscal 2015 and 2014 consists of performance stock unit (“PSU”) awards. Please see Compensation

Discussion and Analysis for a description of the PSU awards. The one-year performance-based test for both fiscal 2015 and 2014 was

met at the 100% target. The fair value of the PSU awards are reported at 100% of target, which is the estimated outcome of performance

conditions associated with the PSU awards on the grant date. If the Company achieves the highest level of performance for the PSU

awards, then the fair value of the PSU awards would be $2,250,125, $2,250,125, $15,669,206, $2,512,588, $2,625,051, $1,350,132 and

$2,137,661 for Mr. Eisenberg, Mr. Feinstein, Mr. Temares, Mr. Stark, Mr. Castagna, Ms. Lattmann and Mr. Fiorilli, respectively. The value

of stock awards granted in fiscal year 2013 consists of restricted stock. Except as described below, the vesting of restricted stock awards

granted in fiscal 2013 depends on (i) the Company’s achievement of a performance-based test for the fiscal year of the grant, and

(ii) assuming the performance-based test is met, time vesting, subject in general to the executive remaining in the Company’s service on

specific vesting dates. The performance-based test for fiscal 2013 was met, and the fair value of such performance-based stock awards

are reported at 100% of target, their maximum value assuming the highest level of performance. The vesting of restricted stock awards

granted to Ms. Lattmann in fiscal 2013 and a portion of restricted stock awards granted to Mr. Castagna in fiscal 2013 are based solely on

time vesting.

31