Bed, Bath and Beyond 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

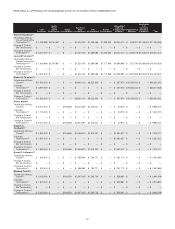

PROPOSAL 3—APPROVAL, BY NON-BINDING VOTE, OF 2015 EXECUTIVE COMPENSATION

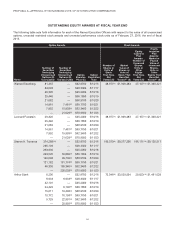

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

Option

Exercise

Price ($)

Option

Expiration

Date

Number of

Shares or

Units of

Stock

That Have

Not

Vested (#)

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested(1) ($)

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights

That Have

Not

Vested (#)

Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights That

Have Not

Vested(1) ($)

Eugene A. Castagna 8,933 8,933(5) $28.3300 5/11/17 62,558(10) $3,064,716 30,880(16) $1,512,811

32,101 — $45.2000 5/10/18

24,422 6,106(5) $56.1850 5/10/19

15,611 10,408(5) $68.9100 5/10/20

10,772 16,158(5) $69.7750 5/10/21

5,725 22,901(5) $62.3400 5/12/22

— 32,443(5) $70.9550 5/11/23

Susan E. Lattmann 2,862 11,451(6) $62.3400 5/12/22 17,407(11) $ 852,769 15,693(17) $ 768,800

— 17,303(6) $70.9550 5/11/23

Matthew Fiorilli 41,029 — $32.8700 5/12/16 58,342(12) $2,858,175 25,298(18) $1,239,349

35,731 8,933(4) $28.3300 5/11/17

32,101 — $45.2000 5/10/18

24,422 6,106(4) $56.1850 5/10/19

15,611 10,408(4) $68.9100 5/10/20

10,772 16,158(4) $69.7750 5/10/21

5,725 22,901(4) $62.3400 5/12/22

— 25,955(4) $70.9550 5/11/23

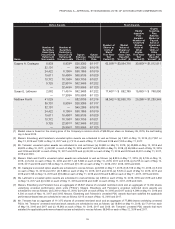

(1) Market value is based on the closing price of the Company’s common stock of $48.99 per share on February 26, 2016, the last trading

day in fiscal 2015.

(2) Messrs. Eisenberg and Feinstein’s unvested option awards are scheduled to vest as follows: (a) 7,481 on May 10, 2016, (b) 7,951 on

May 12, 2016 and 7,952 on May 12, 2017 and (c) 7,210 on each of May 11, 2016 and 2018 and 7,209 on May 11, 2017.

(3) Mr. Temares’ unvested option awards are scheduled to vest as follows: (a) 50,880 on May 10, 2016, (b) 49,869 on May 10, 2016 and

49,870 on May 10, 2017, (c) 60,591 on each of May 10, 2016 and 2017 and 60,592 on May 10, 2018, (d) 46,336 on each of May 12, 2016

and 2018 and 46,337 on each of May 12, 2017 and 2019 and (e) 45,200 on each of May 11, 2016 and 2018 and 45,201 on May 11, 2017,

2019 and 2020.

(4) Messrs. Stark and Fiorilli’s unvested option awards are scheduled to vest as follows: (a) 8,933 on May 11, 2016, (b) 6,106 on May 10,

2016, (c) 5,204 on each of May 10, 2016 and 2017, (d) 5,386 on each of May 10, 2016, 2017 and 2018, (e) 5,725 on each of May 12,

2016, 2017 and 2018 and 5,726 on May 12, 2019 and (f) 5,191 on each of May 11, 2016, 2017, 2018, 2019 and 2020.

(5) Mr. Castagna’s unvested option awards are scheduled to vest as follows: (a) 8,933 on May 11, 2016, (b) 6,106 on May 10, 2016, (c) 5,204

on each of May 10, 2016 and 2017, (d) 5,386 on each of May 10, 2016, 2017 and 2018, (e) 5,725 on each of May 12, 2016, 2017 and

2018 and 5,726 on May 12, 2019 and (f) 6,488 on each of May 11, 2016 and 2018 and 6,489 on each of May 11, 2017, 2019 and 2020.

(6) Ms. Lattmann’s unvested option awards are scheduled to vest as follows: (a) 2,863 on each of May 12, 2016, 2018 and 2019 and 2,862

on May 12, 2017 and (b) 3,460 on each of May 11, 2016 and 2018 and 3,461 on each of May 11, 2017, 2019 and 2020.

(7) Messrs. Eisenberg and Feinstein have an aggregate of 26,947 shares of unvested restricted stock and an aggregate of 12,030 shares

underlying unvested performance stock units (“PSUs”). Messrs. Eisenberg and Feinstein’s unvested restricted stock awards are

scheduled to vest as follows: (a) 5,340 on May 10, 2016, (b) 4,354 on each of May 10, 2016 and 2017 and (c) 4,299 on May 10, 2016 and

4,300 on each of May 10, 2017 and 2018. Messrs. Eisenberg and Feinstein’s unvested PSU awards that have satisfied the applicable

performance-based test are scheduled to vest as follows: 6,015 on each of May 12, 2016 and 2017.

(8) Mr. Temares has an aggregate of 111,472 shares of unvested restricted stock and an aggregate of 77,898 shares underlying unvested

PSUs. Mr. Temares’ unvested restricted stock awards are scheduled to vest as follows: (a) 18,600 on May 10, 2016, (b) 17,414 on each

of May 10, 2016 and 2017 and (c) 19,348 on each of May 10, 2016, 2017 and 2018. Mr. Temares’ unvested PSU awards that have

satisfied the applicable performance-based test are scheduled to vest as follows: 38,949 on each of May 12, 2016 and 2017.

35